Gone are the days when you had to wait in line at a brick-and-mortar building to transfer money or pay your bills. Customers require convenient banking services on their fingertips. “Anytime anywhere banking” becomes a motto for banks who want to keep up with the speed of the modern world and stay in the league.

The bank branch is no longer the primary banking channel. Branch visits are declining. Physical bank branches are closing, while customers expect to do more with their banks without ever having to set foot inside an office. E-banking has surely become an important standard in the banking sector. It enables us to extend services beyond the normal working hours and outside banking halls.

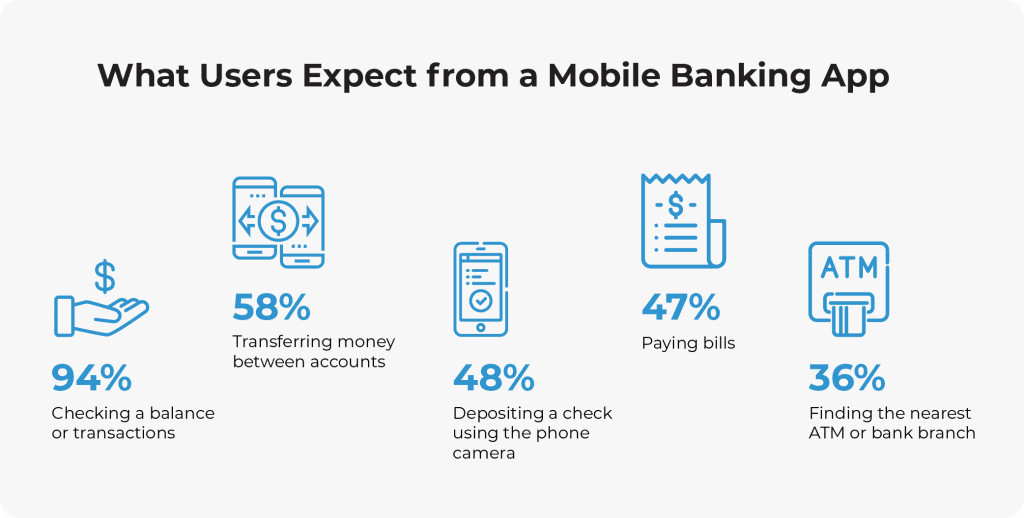

According to the Federal Reserve System’s report, banking users’ expectations look as shown below:

Online banking has been around for a while compared to mobile banking, but due to the increased mobility, the widespread use of smartphones, tablets, wearable devices and the idea of constant connectivity it is slowly yielding its position to mobile banking. Downloads of finance apps in the world hit 3.4 billion in 2018 – that’s 75 % more than three years ago, says Silicon Valley analytics company App Annie. The fight for a special place in their client’s smartphone has already begun for banks.

E-banking for enterprises

E-banking is in demand not only among individuals. In this technological era, enterprise mobility solutions are becoming an integral part of the corporate world. Corporate finance mobile app solutions cover different applications, which can help businesses to transform their organizations. This trend gains in popularity both among large corporations and SMEs.

This is also true for businesses willing to optimize their banking activities and use their bank’s app instead of managing finances the old-school way. Apart from individuals, the banks’ client base includes both corporations and SMEs. They need to make all kinds of transactions and payments, manage their accounts, run payroll calculations, etc. acting as legal entities. All these can be done via the web channel and mobile applications.

In addition, using finance apps, employees can follow updates in the entire organization. They can also make their own contributions from wherever they are. As a result, the company no longer needs workers to be physically present at the head office or branch.

It comes at a cost

The cost of banking app development depends on a variety of factors: app functionality required by the client, its design (the more sophisticated it is, the higher the price), supported platforms, etc. In general, you might expect the figure to fall within the range of 20,000 to 400,000 $.

The price may be high, but with a well-developed app, the bank gets a great tool to improve customer experience and engagement, increase efficiency, cut costs, enhance its brand and image, attract customers, optimize business processes, etc. So, in the end, you’ll have to make peace with extra costs. After all, there are always ways to reduce them.

One framework to rule them all

Traditional mobile app development can be expensive, slow and disappointing. If you need a mobile app for your bank, the most obvious factor to influence your budget is the platform. At present, the most popular are iOS and Android. Considering the fact that each has its own challenges and opportunities and requires a technologically different development process, you’ll need to hire a team for each platform. Thus, we already have two different teams and a third one if you want to maintain and support your web channel (bank services portal, online banking).

You have to pay these three teams separately, and well enough to deliver a quality product. One channel requires on average 6 to 8 developers. In addition, they can be from different software development firms, which complicates the development process and reduces the chances to get equally performing products. Of course, you may stick with only one platform, but both platforms have passionate followers and that should not be excluded.

What can be done in this situation? The answer is simple – employ a hybrid mobile app development company. Of course, having the frontend created in this way won’t fit each OS perfectly, but advanced frameworks like React.Native allow creating apps that are similar to native ones in design and performance as much as possible.

Why React.Native?

React.Native is widely applied for writing cross-platform high performance apps using a single business logic codebase. Its developers were able to take the core architecture of how you design applications using reusable components and React and apply that same fundamental philosophy over to React.Native projects. In this way React developers will have a very similar experience using React.Native. If a software development company approaches the design of both web and mobile software products diligently, with online banking software written in React.JS, up to 70 % of the online banking software code can be reused for a mobile banking application. Being one of the most efficient and reliable cross-platform development tools, React.Native is used by many leading companies and tech giants to develop their mobile apps.

Of course, hybrid apps are not native apps, and they do have shortcomings. A hybrid mobile app is not as cheap as building a native app for a single platform, but it is often 30 to 50 % less expensive than building a separate native app for each platform. It varies depending on the specifics of the app. The business software developer’s speed for hybrid and native platforms is approximately the same if you build simple applications. If you add animation elements, special menus, etc., the hybrid development process becomes more complicated and may require more development efforts in comparison to the native process. However, we have further cost cuts due to the transfer of the hybrid code to the second platform. That is why we may talk about 50 % cost reduction only for less sophisticated apps, with the real figure being 30-40 %.

It’s not about development only

The core issue here is that development is just the tip of the iceberg. We should bear in mind that the price of an app is not limited to its development only, which may represent only around 35 % of the total cost. It is also about constantly improving your app, based on feedback and suggestions. Companies may oversee it in their calculations, and costs for deployment, support, and the ongoing maintenance fall into the hidden category. The math here is pretty simple. You pay for development, maintenance and support of each separate channel if you go the “native” way. Or you apply to a software development company whose team members have expertise in React and React.Native. In this case, you basically pay for a single (hybrid) process rather than three separate ones (web, iOS, and Android). Furthermore, JavaScript developers are reasonably cheaper than iOS developers.

As opposed to native app development, you will only need a single app to work across iPhone and Android phones, as well as iPads and tablets. This is the developer’s version of the “all included” approach. Not only does it cost less, but it is also significantly less time-consuming.

Less is more

Your app has to be simple enough for customers to find what they want and perform any transactions within minutes. A common mistake is thinking your business app has to be packed with all imaginable features. However, the reality is that half of them won’t even be used. Simplicity ensures a great user experience, something every mobile user demands and expects.

You might expect the vast majority of mobile banking app users to be affluent and tech-savvy young adults. The truth is, the user base is far more diverse. In order for the app to be popular and receive positive feedback from a wider audience, it should be pretty simple and user-friendly. No one actually needs sophisticated 3-D graphical elements and an extremely varied user interface when managing finances. A banking app should be efficient, reliable and secure with a simple yet attractive layout.

That is why React.Native may be the best framework for hybrid mobile app development in these cases. Basically, since it works best with simpler apps.

Stay safe

You may strengthen e-banking security with the help of embedded hardware of smartphones. Beyond traditional usernames and passwords, banks adopt new tools for protecting their customers. Among them are:

- Biometrics:fingerprint identification; facial recognition; iris scanning.

- Voice recognition: A number of banks now offer voice recognition as an alternative to passwords.

- PIN/TAN systems: The PIN is a password you need to login to the app. TANs (transaction authentication numbers) are a one-time password for transaction authentication. They are usually sent separately, via SMS, email, or postal services.

React.Native directly supports standard peripheral equipment like cameras, microphones or scanners. You may need plugins for something unique, for example, for the digital signature module which operates at the hardware level.

Two birds with one stone

There is no doubt that native apps offer speed and high performance. However, developing for multiple platforms such as iOS and Android can increase mobile app development costs, and React.Native’s pros objectively outweigh its cons. In such cases, cross-platform development can significantly reduce costs. The apps developed on cross-platform can be accessed and updated easily. In its turn, it will save the app development cost and effort. Moreover, you can ensure that users access the latest version of the app.

All you need is just a professional developer with extensive experience in working on cross-platform tools. As a result, using hybrid platforms for e-banking software development will become a mutually beneficial enterprise for all the parties involved.