Investment is, indeed, one of the safest ways to keep money growing and multiplying. More than simply saving your money, investing your money may help you to increase it faster than ever.

And just like Brian Tracy discussed in his book “The 21 Absolutely Unbreakable Laws of Money”, your ultimate financial goal should be to accumulate capital until your investments are paying you more than you earn at your job. Simply put, investing your money has a lot of advantaged in securing your future and helps to ensure that the “yearning” years are spent resting.

And just like Brian Tracy discussed in his book “The 21 Absolutely Unbreakable Laws of Money”, your ultimate financial goal should be to accumulate capital until your investments are paying you more than you earn at your job. Simply put, investing your money has a lot of advantaged in securing your future and helps to ensure that the “yearning” years are spent resting.

Luckily, a prospective investor or a current investor is able to make use of modern tools which are now available for use. These tools include various applications (both web based and Android / iOS- compatible) which can be used to carry out various investment activities, including decision making and actual funding.

Here are some of the best investing tools and apps that a small business owner can use to optimize their investments.

But First: Invest in Yourself!

This is the most important one: Your #1 investment target is your own business, as well as your personal growth. Another rule from Brian Tracy is:

“Here is a rule that will guarantee your success: and possibly make you rich: Invest 3 percent of your income back into yourself.”

Whenever you are thinking about investing, think about yourself first. The options may include:

- Consider enrolling in classes on business operation, leadership, etc.

- Invest into exploring more marketing channels: Keep an eye on trends! Zest is a great tool to keep an eye on emerging digital marketing trends and experts to keep an eye on (and possibly hire for consulting)

- Invest in customer relations and retention. This is crucial! Before even investing into marketing, think about better utilizing your site current traffic. Hire an analytics expert to turn your traffic logs into actionable analysis into how to engage and retain those people better.

- Invest in outsourcing and delegating tasks that take up most of your time and prevent you from innovating

Now that that’s taken care of, let’s see how to research more investing options:

Small Business Owners’ Investment Mobile Apps

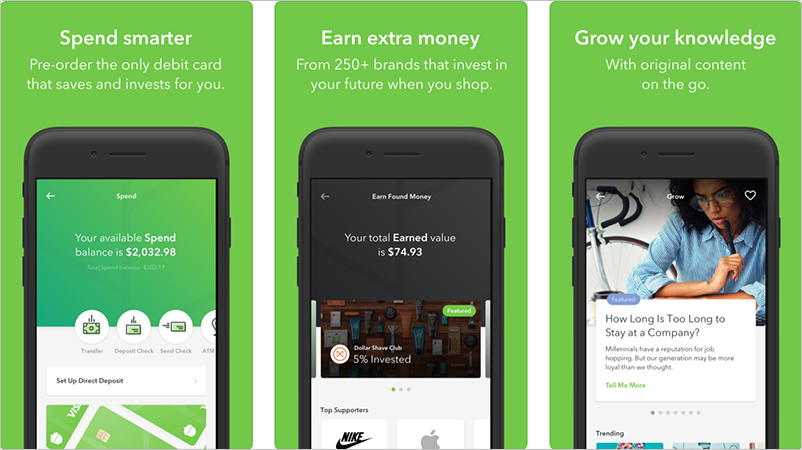

1. Acorns

Acorns remain one of the top investments and stock trading apps to have. The application is an easy-to-use beginner app for any investor. The application operates by building a stock portfolio for you to help you make smart investment decisions. Of course, you can easily move money to your Acorn account by connecting it to your bank account.

Acorns app also has a feature that gives you advice and helps you build your portfolio with your investment goals in mind and based on the questions you have answered. If you’re planning to save towards your retirement, then Acorns is one of the best apps to consider as it helps you to spend your income wisely.

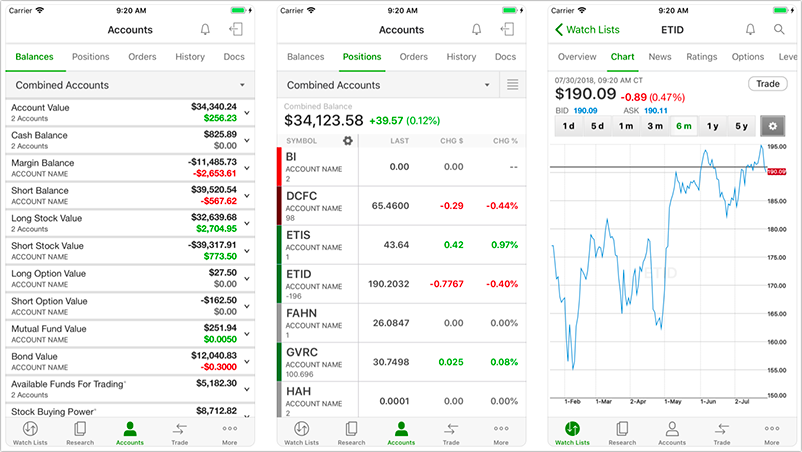

2. TD Ameritrade

The TD Ameritrade offers various mobile apps to help investors. They have the TD Ameritrade mobile app as well as the TD Ameritrade Mobile Trader. These are stock trading apps which unite various investment activities in one place. The apps aren’t only easy to navigate through, but are user-friendly as well.

The apps give the required knowledge and information that is needed for the trading and investment activities. Also, TD Ameritrade gives you alerts, charts, and analysis. The application also allows you to monitor your position in the investor’s market. If you are a beginner, it is may be advisable to try out the TD Ameritrade apps as they have features that allow you to watch videos on various types of trades and their operations.

Out of all apps listed here, these two are probably the least beginner-friendly. If you are just starting to learn investing, you are likely to be intimidated by all the numbers and charts. It is a very solid solution for experienced investors though, so make sure to have it on your list for further reference.

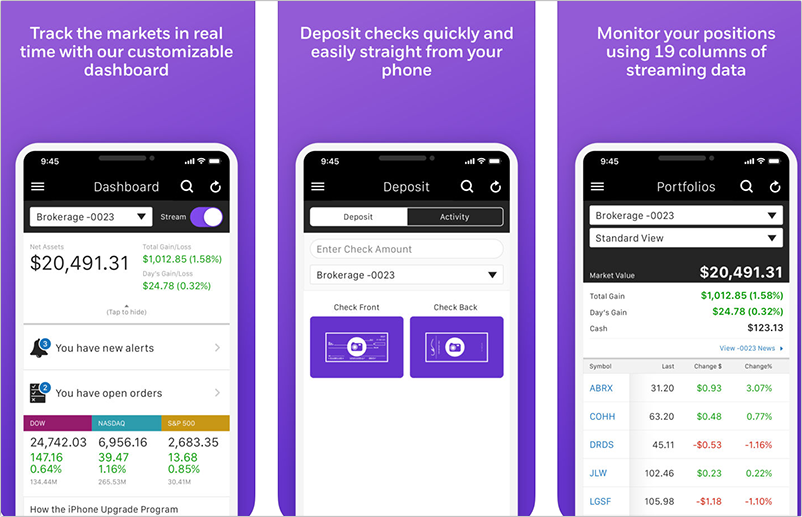

3. E* Trade

E-Trade is another of the iOS/ Android compatible apps for investors. It has proven to be one of the leading apps that encourage online trading and investment. The application allows you to create a profile and log in to gain access to educational resources as well as trade stock market tools.

The app is quite user-friendly and supplies investors with accurate quotes at regular intervals and at the time required. They offer a commission for frequent traders on their platform. There is OptionsHouse, another mobile app for stocks which belongs to E-trade.

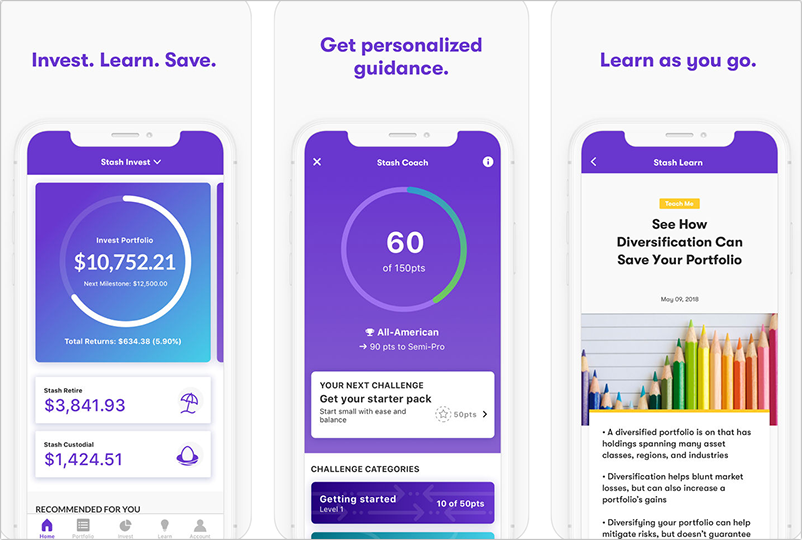

4. Stash

Does an investment interest you but you are only willing to move forward slowly? Then Stash is the best investing app for you. It allows you to invest as low as $5 and even helps you through every process of your investment with the necessary advice.

The app makes the whole process of investment effortless for beginners in the field of investing. It also contains tips and information making learning much easier.

5. Robinhood

Robinhood is another top investment application for investors that is available for use. The app works well especially if you are dealing with exchange-traded funds, stocks, and even Bitcoin! Basically, the application helps you to track your stocks as well as the ones on your watchlist. To top that all, that the app is absolutely free!

After logging into account, you can set up your challenges and then start complete those challenges to earn points, self-educate, and become a healthier investor.

Small Business Owners’ Investment Desktop Tools

While mobile apps are fun, many small business owners need to have a solid desktop collection too, as they spend most of their work time in front of the computer.

Here’s a quick collection of desktop tools and resources to start with:

- The Motley Fool provides solid insight about stocks to help both beginner and experienced investors stay informed.

- Coinflare is a must-use for any investor who is interested in cryptocurrency. There are various different types of cryptocurrencies and crypto-assets being tracked through the platform and it also allows to easily do all kinds of cryptocurrency conversions.

- Ellevest is a digital investment advisory firm focusing on women. It has a solid collection of educational resources you can subscribe to using their site.

Finally, Cyfe is an online business app allowing you to consolidate all your investment resources and tools within one handy dashboard. It supports all kinds of widgets allowing you to track your finances as well as quickly see updates from your RSS feeds and subscriptions.

Apart from being a solid investment management solution, Cyfe allows you to optimize just about anything, including content marketing and developement, and keep all aspects of your business management under one roof.

If you like using your own site to keep things under your control, there are a few options allowing you to build a DIY monitoring dashboard but it will require some development effort.

Investing in trade and stock exchange and also tracking these investments have become much easier with the various apps and tools. Give those apps a try and then choose the one that best suits your need, and enjoy the beneficial returns of good investment with the right advice and ideas.

Are there any other tools and resources you are using to make informed investing decisions? Please share them in the comments!