When it comes to securing a loan, it’s a common path many of us take to fulfill our needs. Without trying to imply that normalcy equates to goodness, three out of four Americans have outstanding loan balances in one manner or another. Yet, there’s an important aspect that often goes unnoticed: the factors that can unexpectedly increase your total loan balance over time.

Loans may seem like a financial lifeline, but there are hidden elements that can cause your debt to balloon beyond imagination. In this article, we’ll delve into four critical factors that wield immense power in determining the growth of your loan balance. Understanding these factors will empower you to make savvy choices and ultimately decrease your total loan balances.

1. High Interest Rates

High-interest rates can pack quite a punch when it comes to loan balances, causing a ripple effect that amplifies the overall cost of borrowing. When those rates soar, lenders tack on a higher percentage of your loan amount as interest, leading to heftier interest charges that pile up over time.

Interest rates can be particularly nefarious when you start carrying a balance (more on that later). The effects of this are rather notorious in the cases of short-term loans like payday loans, title loans, and cash advances.

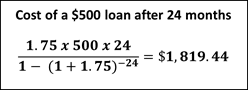

For example: Imagine you take out a 500 dollar loan at a 175% APR repayable over a 2-year period. Your loan balance would end up looking something like this:

This means you’d have to pay a whopping $1,319.44 in interest – the equivalent of 364% more than you initially owed. Do this exact calculation with higher numbers to get a clue of how much money you could lose with interest rates of this caliber!

2. Extending Your Loan Term

Choosing to extend the loan term or repayment period might seem like a tempting solution to ease the burden of monthly payments but trust me – it’s like dumping rocket fuel in an already exploding loan balance!

When you prolong the repayment period, you inadvertently give more time for interest to work its magic on the remaining balance. Considering what we just explained regarding interest rates, stretching your loan period beyond what was originally agreed upon will only inflate your loan balance beyond recognition.

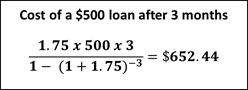

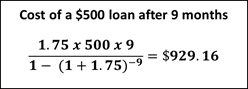

For example: Compare the figures below to see how much your total loan balance would be after 3 months versus 9 months for a 500 dollar loan.

Even when there’s nothing wrong with asking for time (provided the lender is lenient enough), you should aim for the quickest reimbursement possible – even if that entails a more austere monthly budget – lest your loan balance tailspins.

3. Late Payments and Penalties

Late payments and penalties can wreak havoc on your loan balance, causing it to swell unexpectedly. When life gets busy and payments slip through the cracks, you open the door to a whole world of trouble.

Lenders, unfortunately, aren’t too forgiving when it comes to late payments, and they’re quick to slap you with penalties for not sticking to the agreed-upon payment schedule. To make matters worse, they may even hike up your interest rate consequently, leaving you to shoulder higher borrowing costs.

To dodge these financial pitfalls, it’s crucial to stay on top of your payment game. Here are a few tips:

- Set up friendly reminders or take advantage of automatic payments to ensure those due dates never slip by unnoticed.

- If you hit a rough patch and can’t make a payment on time, don’t panic! Reach out to your lender, have a heart-to-heart chat, and explore alternative payment options or temporary relief.

Paying your loan before its due time could save you from an avalanche of additional costs that would otherwise inflate your total loan balance.

4. Borrowing Additional Funds

When you’re already repaying an existing loan, deciding to borrow additional funds can pack quite a punch on your total loan balance. It’s like your gym buddy adding more weights to your bench-press while you’re already struggling to complete your rep!

Borrowing from an already existing lender means that, unless you resolve to pay higher monthly installment amounts, it’ll take longer to pay off the loan, which in turn engenders more interest, not counting the fees that might ensue. Hence, your loan balance will irremediably get even beefier!

So, before you dive into more borrowing, pause, and reflect on your long-term financial goals. Assess whether the additional debt aligns with your aspirations and, most importantly, if you have the means to manage the extra financial weight.

Conclusion

As we arrive at this article’s conclusion, let’s recapitulate the four factors that could balloon your total balance:

- High interest rates: Interest rates are the cost you assume for borrowing money from another person or organization. On some occasions, this cost could potentially amount to double the initial loan balance or even more.

- Loan term extensions: The longer the term of your loan, the more interest charges you’ll be levied.

- Late payments and penalties: Your debt balance may increase not only on account of the late fee but the interest it generates.

- Borrowing additional funds: You should avoid packing additional debt on top of what you already owe to your lender.

Reading the above, you might already notice a recurring pattern: Interest and, to a slightly lesser extent, fees are at the heart of each of the aforementioned factors and become the primary determinants behind virtually every loan balance increase.

To elude this, try to proactively manage your finance and do proper budgeting. Furthermore, take the aforementioned factors into account every time you consider applying for a loan and only borrow when strictly necessary.

Lastly, don’t discard the aid of a qualified financial advisor. They can guide you in effectively handling your debt and preventing your loan balance from blasting-off!