The convenience of quickly accessible online services is priceless, and the use of smart things is becoming more and more widespread. This translates into the growing role of digital identity across various industries. But this also leads to a bigger need for strong data security and privacy in identity verification technology. So where do we stand now in this regard? Let’s discuss.

What is digital identity?

Digital identity verification is the process of confirming the authenticity of an individual’s identity using electronic means. In a world increasingly reliant on digital interactions, this verification process has become essential for secure and seamless online transactions.

Digital identity verification employs various methods to ensure the legitimacy of an individual’s identity. The data exists as a file that contains personally identifiable information on the person or party, like the following:

- passport number

- date of birth

- social security number

- biometric data

- bank account number

- driver’s license number

- login credentials

Information that makes up a digital identity is collected by computers and systems through actions the person performs online. It can then be assigned to a unique ID or to the person’s IP address. Often, the digital identities of people are linked with their national IDs.

So what is the use of digital identities? They allow the use of online or electronic services, hence giving people access to the perks of automation. Based on the person’s actions and patterns of behavior online, organizations can use digital identity data to enhance their services and advertising through personalization.

How does the digital identity verification process work?

The computer can’t identify whether the person logging into a website uses their or someone else’s ID information. Hence, this poses a threat of identity theft and other risks associated with privacy and security. That’s when the digital identity verification process comes into action.

The goal of digital identity verification is to confirm that the person providing personally identifiable data is the owner of the information. The process of digital identity verification implies a validation of the user by his or her identifying characteristics.

While there are lots of methods of digital data verification, all of them work by comparing what the user has, such as a document or a selfie, with previously verified data, like that held by the government. If the presented data matches the existing one, then the user is verified and can proceed.

Operational mechanisms

As was already mentioned, digital identity verification employs various methods to ensure the legitimacy of an individual’s identity. Common mechanisms include:

- Document Verification: Users may be required to submit official documents, such as government-issued IDs or passports, which are then verified electronically.

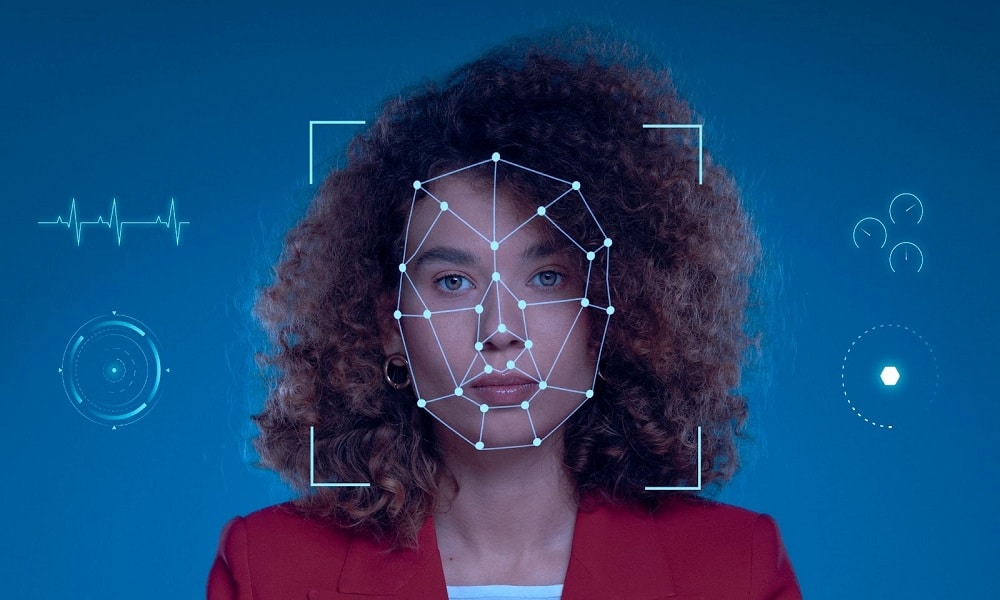

- Biometric Verification: This involves using unique biological traits like fingerprints, facial recognition, or iris scans to confirm identity.

- Knowledge-Based Verification: Users answer personalized questions or provide specific information to prove their identity, such as details from credit history or personal records.

Applications across industries

Financial services

Digital identity verification is extensively used in banking and financial institutions to facilitate secure online transactions, account openings, and fraud prevention.

Healthcare

In the healthcare sector, digital identity verification ensures secure access to patient records, protects sensitive medical information, and aids in telemedicine practices.

E-commerce

Online retailers leverage digital identity verification to mitigate fraudulent transactions, enhance customer trust, and streamline the online shopping experience.

Government services

Government agencies use digital identity verification to secure access to official portals, process online applications, and ensure the integrity of digital interactions with citizens.

Legal considerations

Data Protection Laws

Digital identity verification must comply with data protection regulations such as GDPR, ensuring that personal information is handled securely and transparently.

Consent and Privacy

Users should provide informed consent before undergoing digital identity verification, emphasizing the importance of respecting privacy rights.

Euristiq, as a brand, plays a pivotal role in advancing digital solutions. In digital identity verification, Euristiq contributes by developing innovative and secure systems that align with industry standards and regulatory requirements. By leveraging cutting-edge technologies, Euristiq aids businesses in implementing robust digital identity verification processes tailored to their specific needs.

Digital identity verification has become an indispensable component of online interactions, ensuring security, trust, and efficiency across various sectors. As the digital landscape continues to evolve, brands like Euristiq contribute to shaping the future of secure and seamless digital identity verification solutions. Balancing technological advancements with legal and ethical considerations remains crucial to fostering a digital environment that is both innovative and responsible.