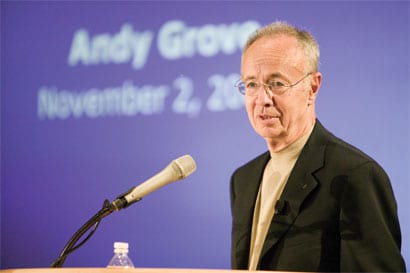

Recently when I saw the announcement that Paul Otelllini, the current CEO of Intel, was retiring, I immediately thought of Andy Grove, a former CEO of Intel who is generally viewed as one of the greatest CEO’s of our times.

Andy made enormous contributions to Intel. He was the driving force behind the decision to transform Intel from being a manufacturer of memory chips to instead, take the risk that the personal computer business was going to be big and that Intel should be able to manufacture a microprocessor good enough to power IBM’s first personal computer.

- After much work, Grove got IBM to use Intel microprocessors when they launched the IBM Personal Computer. The IBM PC was a huge success, spawned many hardware clones that also relied on Intel microprocessors, and Intel quickly became a giant business.

- Grove served as CEO of the company from 1987 until 1998, and during that period the stock price increased by +2400%.

A simple business philosophy

Grove is famous for his simple business philosophy. According to Grove; “Business success contains the seeds of its own destruction. Success breeds complacency. Complacency breeds failure. Only the paranoid survive.”

Grove explains his reasoning: “A corporation is a living organism; it has to continue to shed its skin. Methods have to change. Focus has to change. Values have to change. The sum total of those changes is transformation.”

Another reason why I bring up Andy Grove is that his record is so drastically different from that of Intel’s retiring CEO, Paul Otelllini. While during his 8 year tenure as CEO, Otellini did a fine job preserving Intel’s 80+% share of the PC microprocessor market and that is a major accomplishment. On the other hand, the company’s stock price is actually off -4% versus the price when Otellini took over as CEO 8 years ago.

Why the lackluster stock price performance?

The personal computer business is starting to decline, for the first time in history, and the big growth areas for microprocessors are the tablets and smartphones, both of which are the absolute rage these days.

Unfortunately for Intel, it is struggling with both tablets and smartphones. The big players are ARM and Qualcomm. In fact, it was a real surprise to see recently that Qualcomm has eclipsed Intel’s market capitalization to become the most valuable semiconductor company. Even in servers, Intel could soon face strong competition from rival ARM-based chips.

The real shocker here is that if there was going to be one company who would religiously live by the philosophy of Andy Grove, you would expect it to be Intel!

Three deally traps

So what is the learning here? Success leads to complacency which leads to the following three traps that are deadly:

- Neglect: Sticking with Yesterday’s Business Model – Intel’s ongoing, laser-like focus on personal computers caused them to not really get aggressive early regarding smartphones and tablets. Now they are a minor player trying to catch up in those two emerging components of the microprocessor market.

- Pride: Allowing Your Products to Become Outdated – Kodak was very proud and protective of its film business and failed to realize it was actually in the photography business. Photography went digital and left the now-bankrupt Kodak with a fast declining film franchise that disappeared right before their eyes.

- Lethergy: A Culture of Comfort, Casualness, and Confidence – In the early 1980’s, IBM management was so comfortable with the fat profit margins of the mainframe that it very reluctantly allowed a bunch of renegade employees to launch a personal computer. They cared so little they outsourced to microprocessor to Intel and the operating system to Microsoft without exclusivity clauses, allowing any clone manufacturer to also use the same Intel chip and Microsoft operating system.

It is very clear that Any Grove was dead right: Only the paranoid survive!

Did you like this article? Sign up for our RSS, join us on Facebook, on Twitter and on Google+ to get the latest Tweak Your Biz articles and updates.