Investing in property can be an exciting and lucrative endeavor. Real estate investment strategies can vary, and each comes with its own associated risks. As with all investment opportunities, you should carefully consider everything there is to know about this asset class before including it in your portfolio. Whether you’re a first-time investor or an experienced real estate guru; you’ll need to consider these property investment factors each time.

Types of Real Estate

Residential – The construction and maintenance of new homes as well as the resale and purchasing of homes. They’re essentially residential buildings where you can expect to live.

Commercial – All buildings and land that are owned to produce income.

Industrial – Premises where manufacturing, storage, and production take place.

Land – Vacant land and working farms.

1: Decide on the Type of Property Investment

You’ll probably already know that there are quite a few ways to invest in the property market. You don’t necessarily need to invest in physical property either. For example, Investing in Real Estate investment trusts (REITs) is a great way to generate dividend income whilst leaving the property-operating and maintenance responsibilities to the trust.

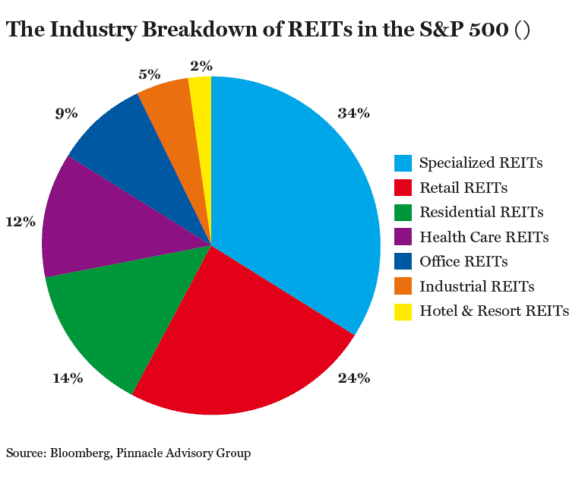

REITs by industry in the S&P 500: (IntlBanker)

The real estate sector has a market capitalization of over $1.48 trillion and at the center of this sector’s growth, is the success of REITs. Real Estate Investment Trusts act as investment agents by pooling funds together to invest in properties that produce income.

Types of Property Investment

Just as there are different types of real estate; there are many ways to invest in the property market. From outright ownership of the residential property to letting out commercial real estate, flipping houses, and contributing to crowdfunding platforms, investment opportunities are vast.

– Mortgage

– Buying for rental

– Real Estate Investment Trusts

– Real Estate Investment Groups

– Property loan notes

– House flipping

– Crowdfunding platforms

2: Clear Your Debt

Experienced investors may well carry debt as part of their portfolio investment strategy, but average investors should aim to pay off personal debt before they invest in property. Do keep in mind that it isn’t necessary to pay down debt if you’ve calculated that the return from your real estate is greater than the cost of debt. Having a ‘cash cushion’ to act as a margin of safety is advisable.

3: Consider Location

If you consider a single thing when investing in real estate – make it location. The last thing you want to be stuck with is money tied up in property investment in an area that is declining rather than stable or improving. This is true of all types of investment – including REITs, loan notes, and crowdfunding.

Location is key to both property appreciation and depreciation. As areas evolve and amenities improve, value is added. This isn’t exclusive to big cities like London. Smaller towns and villages can appreciate in value as the local area becomes more desirable. Value is determined by factors like convenience, reputation, and history.

4: Buy or Finance?

Consider whether you will buy with cash or finance your investment property. The outcome will depend on your goals. For example, paying for a rental property in cash can help generate positive monthly cash flow. Had you spent $100,000, when rental income, taxes, and depreciation are considered; you may be looking at around $9,500 annual earnings. Or, a 9.5% ROI.

Financing a property may well generate higher returns. If an investor puts 20% on the house, compounding at 4% on the mortgage, once all expenses are deducted, the earnings could reach up to $5,580. A lower sum, but a 27.9% annual return on investment.

5: Beware of High-Interest Rates

The cost of borrowing money has been relatively cheap over the past few years, and are forecast to stay low in the wake of the economic downturn. However, interest rates on investment properties tend to be higher than traditional mortgages. If you do decide to finance your investment, compare mortgage rates and find the best possible low-interest rates that won’t eat your monthly profits.

6: Calculate Your Margins

Once you have your expenses under wrap, you’ll be able to calculate your margins more effectively. Costs can include homeowners insurance, association fees, property taxes, monthly expenses, and general maintenance costs. When it comes to profitability, the general rule of thumb is the 2% guide. If you are generating an income of 2% of the purchase price, you’re more likely to generate positive cash flow.

7: Landlord Insurance

Set on becoming a landlord? Great! But make sure you understand what this entails, including landlord insurance. You’ll want to protect your property investment by covering damage, lost rental income, and liability protection.

8: Factor in Unexpected Costs

Property investment is different from investing in company shares, stocks, and bonds. Every asset class carries a certain degree of risks, but in most cases, unexpected costs for property investing falls straight into the investor’s lap. Unless, of course, one opts to invest in a REIT.

The risk of property damage is always imminent. Leaks, floods, structural damage, and broken appliances can happen at any time. These unexpected costs will certainly reduce your net returns. Plan to set aside 20-30% of your investment income for these events.

9: Operating Expenses

For investors who purchase land or property real estate to generate income, it might take some time to fully understand your operating costs. This feeds into one’s ability to calculate their profit margins. However, the 50% rule is generally applicable to most scenarios. For example, landlords who charge £2000 per month, should expect to pay approximately £1000 in total expenses.

10: Tax Implications

Taxes are to be paid when you buy a property, taxes on your income when you rent out a property, and taxes when you sell a property too. This is perhaps the most important thing to understand before investing in property. What taxes should you expect to pay?

Stamp Duty on Residential Property

Payable by the purchaser of a property on completion of the sale. For individual investors, stamp duty on a residential investment property is typically charged at 3% above the rate of the main residence.

Different rates apply for stamp duty on leaseholds, shared ownership, and residential properties bought by companies or trusts. You can use online tools to calculate the amount of stamp duty payable on your investment.

Stamp duty on commercial properties is often lower than residential rates. In fact, a property bought for up to the value of £150,000 is exempt from stamp duty, and at the value of between £150,000 – £250,000, 2% of this portion is payable in stamp duty.

Property Income Tax

Investors are taxed on the income received on their property investments. For investors with multiple properties, this can be expensive, since they could face paying up to 45% on a proportion of their income.

However, there are some allowable expenses that can be deducted from a property investor’s taxable income. These include renovation and maintenance costs. Couple this with the fact that tax is not payable in the event a loss is made, and one can appreciate that the tax advantages are strong.

Corporation tax is payable when an investment property is held in a company – paid by owners, and currently sits at 19%. Dividend income can also be taxed at up to 38.1.

Suburban house -DepositPhotos