Not so long ago statistics showed low adoption levels on Personal Finance Management (PFM) systems. Indeed, the 10-12% adoption rate can hardly be a strong motivation for banks to invest in PFM development. But the financial industry is changing, shaped by customers, who are looking for some financial coaching instead of financial education.

In this text, we will provide market insights and facts in order to prove that PFM is gaining momentum, yet, in a slightly new direction, when compared to pioneer finance management systems.

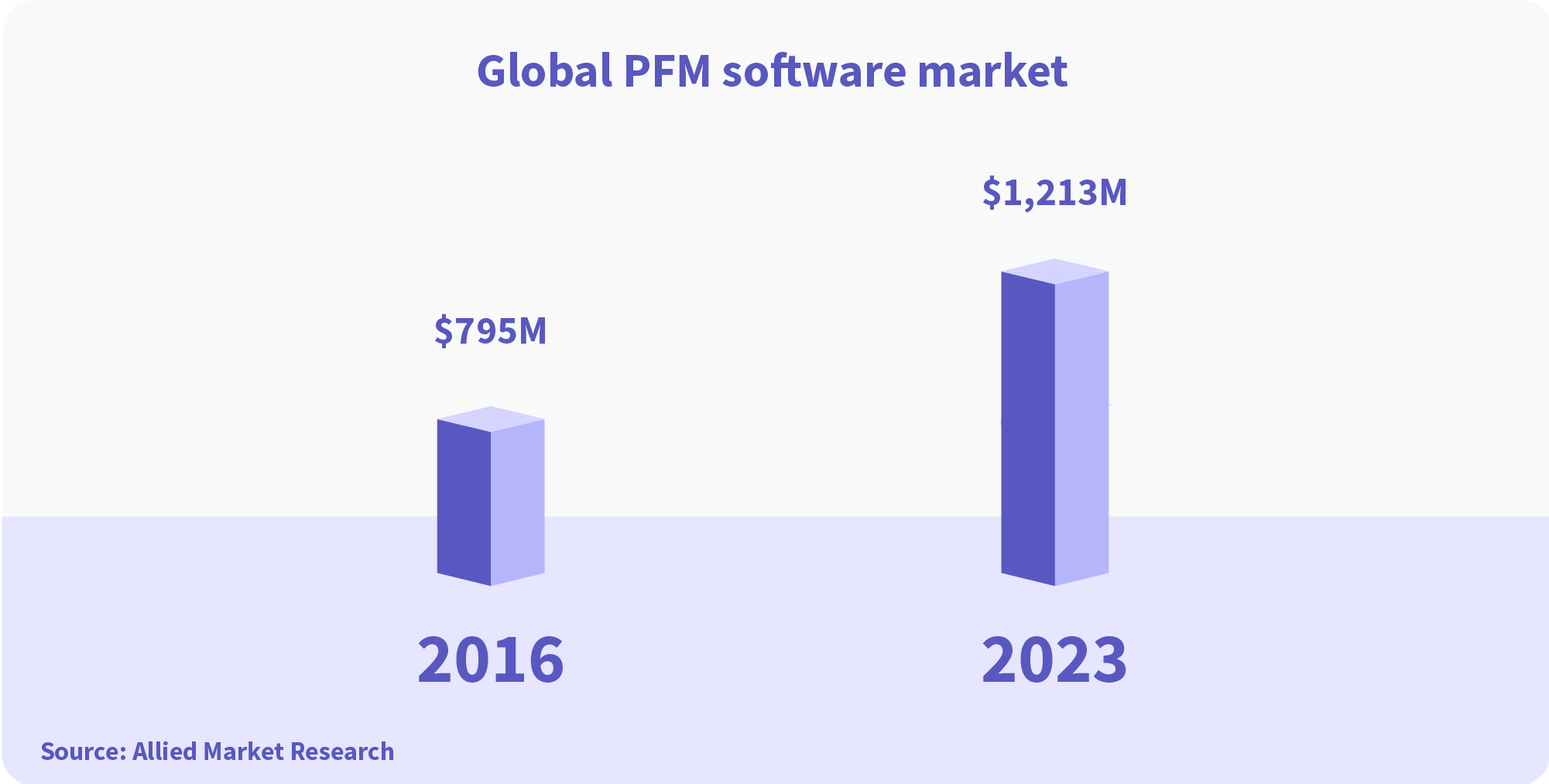

Let’s begin by embracing the real number of users, who are potentially interested in PFMs. The global PFM software market reached $795 million in 2016, according to Allied Market Research. What’s more: it is going to skyrocket to $1,213 million in the upcoming years (by 2023).

PFM adoption in reality

The official rates of PFM consider the use of personal finance management systems integrated into the banking software. They don’t include the use of stand-alone apps, like Mint (budget tracker and planner) or Acorns – (savings automation and investment tool) with 20 and 30-40 million users in the US, correspondingly. These people can also be counted as PFM users (or at least PFM-features users), therefore the real adoption rate is much higher.

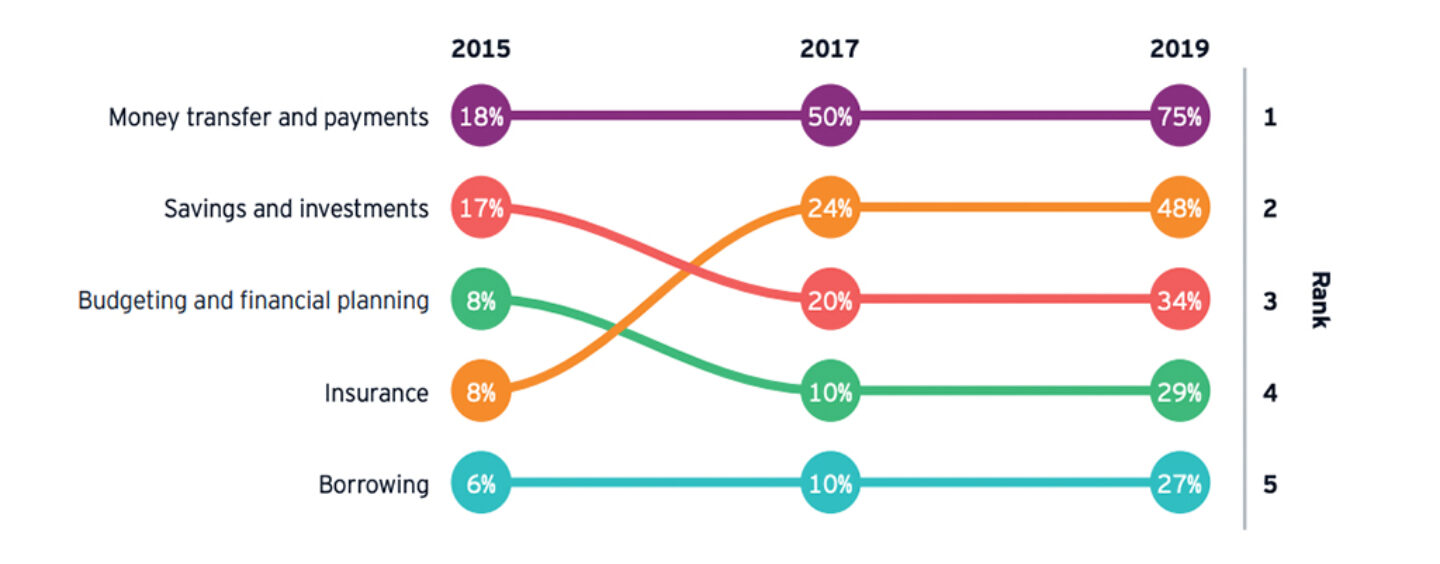

There are some other studies to support this idea. According to Fintech Singapore 2019 research, the global consumer adoption of fintech services is rising in the last couple of years: according to the study, the adoption of budgeting and financial planning started from 8% in 2015, then slowly grew to 10% in 2017 and finally is making 29% in 2019.

In terms of fintech adoption, emerging markets of China and India are leading: the Fintech Adoption Index in both is 87%. Russia and South Africa are close behind having 82%. As far as developed European countries are concerned, the UK, Ireland and the Netherlands are the leaders.

PFM 2.0: reinventing the customer experience

No matter which statistics you are going to use in order to calculate the ROI of PFM software development, it would be hard to get exact numbers. Insights stating that PFM systems have insufficient potential can be based on the usage statistics of some old-school apps and modules with poor functionality and irrelevance to customer’s daily experience.

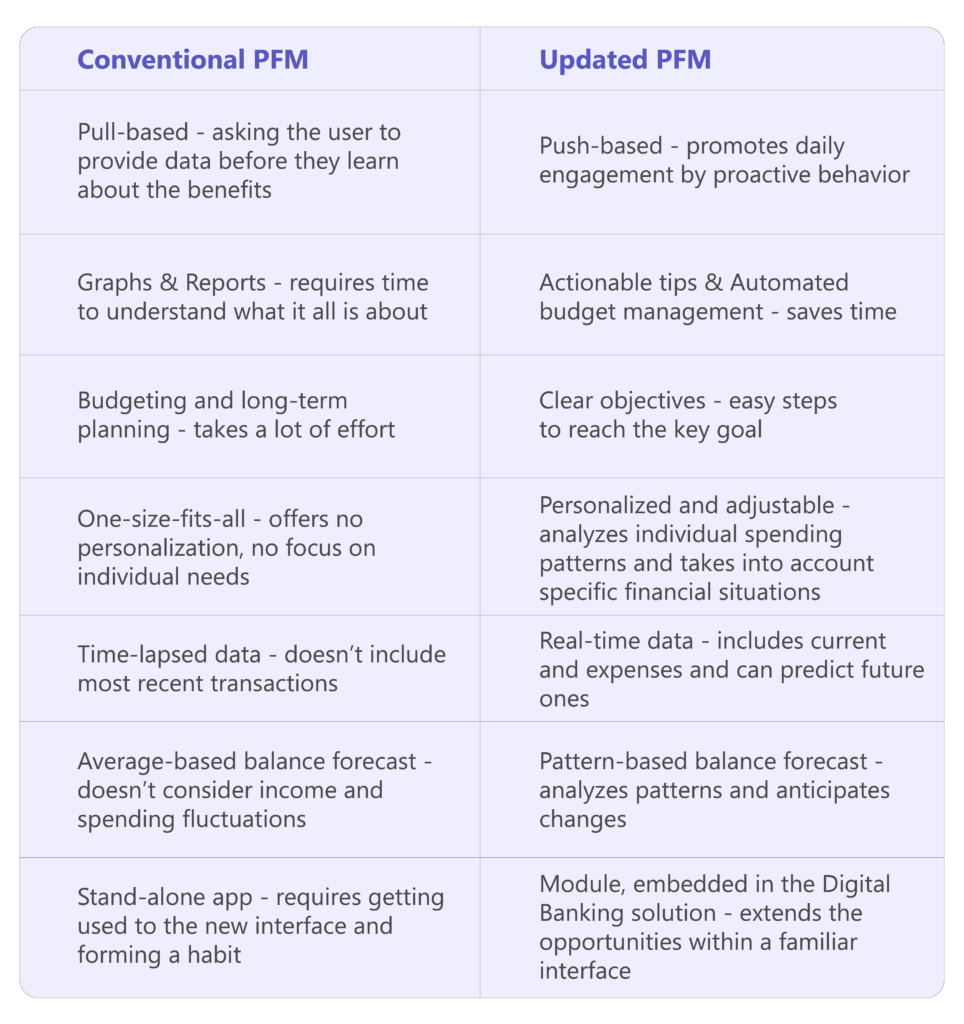

Conventional PFM systems are mostly focused on showing numbers to customers without analyzing them or turning them into actionable recommendations. And that’s exactly what should be changed in order to build exceptional financial management experience and to stand out from the crowd.

Customers want to track what they spend and allocate budgets, highlight upcoming expenses and receive predictions whether they are going to have “more month than money.” This way the bank’s objective is to meet customer expectations and to build an interactive and proactive financial tool. By taking advantage of open banking and connecting to multiple financial accounts of customers banks can create a more holistic picture of their financial state and have more opportunities for upselling and cross-selling.

The idea is to abandon the passive approach based on putting together valuable information and waiting for users to look at it. Banks should pay attention to the contextual delivery of data and tips aimed at changing customer’s behavior — and experienced software development vendors can assist in it.

Examples

- Russia’s Sberbank provides Tips tool based on algorithms, which predict spending in the future considering the user’s lifestyle and purchase history. It provides customers with personalized and proactive advice about rational financial choices. The goal is to suggest future spendings for a financially healthy and pleasant lifestyle.

- Royal Bank of Canada introduced NOMI – a new module, which implements predictive analytics and AI, to sum up daily banking activity through multiple accounts, predict incoming bills that are higher than usual and provide customized insights about debts or suspicious activity. The app also provides spending categorization, comprehensive overviews, and notifications in case your auto-renewal payments (gym or Netflix) are going to increase. Due to the use of AI, NOMI Find & Save app experienced an 8% increase in user engagement, doubled the customer savings and generated 100M insights for its users.

- Tandem Bank released the Autosavings account built on top of the existing mobile app. Based on customer’s spending habits, it automatically puts some money aside and helps to adjust the saving level to the comfortable one (between 5 and 15% of the income.)

- Metro Bank also has an AI-powered PFM service with real-time transaction monitoring. It turns data into practical tips and instructions on how to avoid unnecessary charges.

- Santander Bank created Money Plan – a mobile app, which acts as a financial product aggregator gathering all cards and accounts in one platform. The app offers personalized alerts and suggestions aligned with user’s saving goals.

PFM in Digital Banking allows building loyalty by making the interaction with the brand “not-sales-only”. At the same time, there is a chance to reveal new revenue sources: for example, fee-based alerts of high value. Some customers would appreciate notifications on overdraft probability or detailed financial reports with charts.

Updated PFM systems are more about creating convenience. Technologies that are developed to make lives easier, even if they are saving just 5 or 10 minutes, are game-changing.

Data Integration and Aggregation

Although in Europe the trend of gathering financial data is partially spurred by the legislation, like PSD2, the customer expectations regarding simple access to their financial history is a strong motivation for banks to find “eco” ways of dealing with data (by asking customer’s permission, of course).

Open Banking and API-based access is a great chance to work with account information and allow users to manage their budget via integrated third-party services.

Leveraging data for valuable insights

Analyzing PFM use patterns, banks can divide customers into three categories:

- Active users – those who aggregate their financial products, set an alert or are using budgeting or goal tools (deeply using the module).

- Passive users – those who are tracking their expenses from time to time, but don’t set budgets and goals.

- Non-PFM users

The PFM data can be used to target product offers according to customer lifestyle and needs. Based on transaction classifications it is possible to assume if the user has children, is engaged in sports activities or enjoys eating out. Assumptions like this are a big deal for cross-selling initiatives and higher click-through-rates: 25% in comparison to 7.6% untargeted.

To sum it all up

PFM should be evolving non-stop. Monitoring user involvement greatly assists in guiding this evolution in the right direction. You can take BMO, Rabobank, and PostFinance as an example of banks that keep in touch with their customers: they have focus groups to improve their PFM categorization algorithm.

Personal Finance Management is a must-have for banks, who are ready to transform static platforms into engaging, attractive and cooperation-driven digital products. There are hardly any other solutions, which bring so many insights and so much context for banks, helping them to create new business models.