Let’s say you’re preparing for a grand adventure. The excitement is palpable, but you know you can’t just jump in without the right gear.

Choosing a trading platform is no different. It’s your compass, map, trusty toolkit – your key to navigating the vibrant world of financial markets.

Selecting a provider that aligns with your trading style and aspirations in this bustling online trading platform marketplace is crucial.

Whether you’ve got your sights set on Earn2Trade or you’re curious about SurgeTrader, you’re faced with many choices.

Each platform has its unique allure, much like twinkling stars in the vast sky, but the question remains: which is right for you?

Let’s help you find out, shall we?

- User Interface and Usability

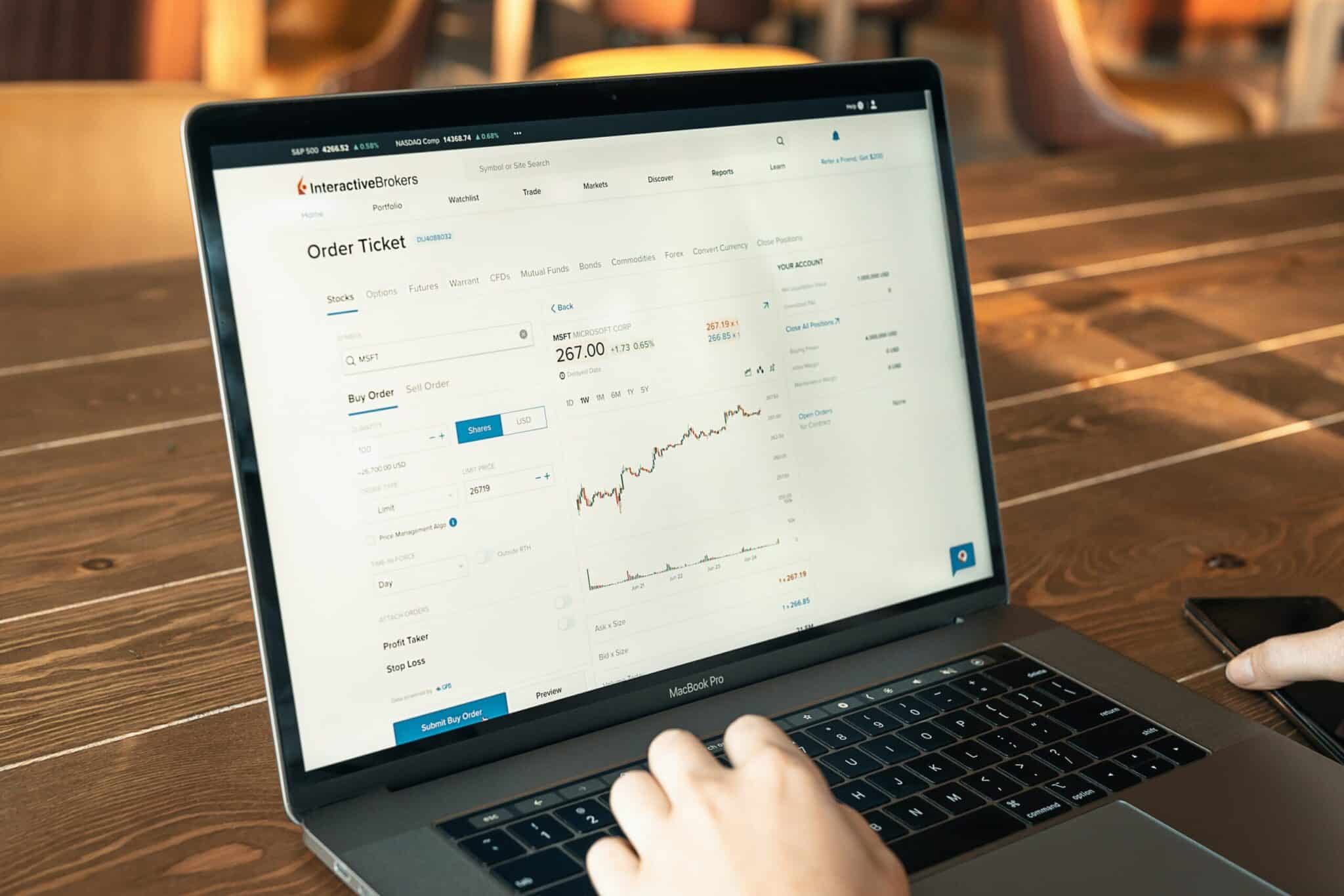

It should feel like home when you first step onto a new trading platform. The user interface is your window into the vast world of financial markets. Therefore, it must be intuitive, easy to navigate, and responsive. A cluttered or complicated interface can lead to costly mistakes.

Think of it like a well-designed car dashboard. You wouldn’t want to fumble around looking for the right controls while driving, would you? Similarly, on a trading platform like Earn2Trade, the ease with which you can execute trades, analyze markets, and manage your account is critical.

Usability also extends to customization. Can you tweak the platform to suit your specific needs? Can you set up alerts, customize charts, and arrange your workspace? A platform that empowers you to make it your own is worth considering.

- Range of Instruments

Trading preferences are as unique as fingerprints – they change and evolve. Today, you might be engrossed in forex trading, but who knows what tomorrow brings? Maybe commodities will pique your interest, or equities will call your name. Hence, the flexibility of your trading platform is crucial, reflecting your dynamic trading inclinations.

Consider a platform as a well-supplied pantry. A robust one, like SurgeTrader, offers an assortment of financial instruments, spanning forex, commodities, and equities.

Just like a well-stocked grocery store, a good trading platform will provide a variety of financial instruments for you to trade.

- Security

Your trading platform is not just a tool. It’s a vault. It’s where your personal information and hard-earned money reside. Therefore, your chosen platform must have top-notch cybersecurity measures in place.

Look for platforms with stringent data encryption, two-factor authentication, and regular security audits. It’s also essential to ensure that the platform complies with regulatory standards. After all, a secure platform is not a luxury. It’s a necessity.

- Trading Costs

No one likes hidden costs, and trading platforms are no exception. Therefore, it’s crucial to understand the platform’s fee structure – the spreads, the commissions, any account maintenance fees, and so on.

These costs can fastly eat into your profits, so choosing a platform with a transparent, reasonable fee structure is essential.

Also, consider the cost of not trading. Some platforms charge inactivity fees if you don’t trade for a certain period.

- Educational Resources

Trading is a journey of constant learning. Whether you’re a novice just starting or an experienced trader looking to hone your skills, the availability of educational resources is crucial. A good trading platform will invest in your growth as a trader.

Look for platforms that offer webinars, tutorials, articles, and market analysis. Some platforms, for example, offer many educational resources, empowering traders to make informed decisions. Of course, the best platform won’t be your trading arena and your learning hub.

- Customer Support

In the trading world, issues can pop up – and when these issues do, you need to know that you can get help fast. So look for platforms that offer round-the-clock customer support. How quickly do they respond? What channels of communication do they provide?

A platform like SurgeTrader is known for its excellent customer support, ready to assist traders 24/7. But remember, effective support is more than just solving problems—it’s also about preventing potential issues.

- Performance and Stability

Time is money. You don’t want to be left hanging while your platform freezes or crashes in the middle of a trade. Look for platforms that are known for their performance and stability.

Also, consider the platform’s speed. How quickly does it execute trades? Is there a significant lag between your command and the platform’s response? A slow platform can cost you valuable opportunities.

- Demo Accounts

Think of demo accounts as the training wheels of trading. They allow you to practice your strategies, learn the ropes of the platform, and gain confidence – all without risking real money.

In addition, platforms offering demo accounts also show they care about your growth and risk management.

Conclusion

In wrapping up, selecting the right trading platform is akin to choosing a trusted partner for your trading journey. You need a platform that complements your trading style, prioritizes security, offers the right instruments, and provides ample educational resources.

Remember the importance of customer support, platform stability, and demo accounts for the practice. Weighing these eight key factors will guide you to a platform that meets your trading needs and aids in your growth as a trader.

Remember, having a reliable platform can make all the difference in the dynamic world of trading. Choose wisely and trade confidently!