Growth in cutting-edge technologies disrupts every industry and reshapes it, and the insurance industry is no exception.

Identifying and adopting the latest tech trends for the insurance industry can help you keep up with the evolution and stay ahead of competitors.

In this post, you will learn about seven of the most prominent tech trends for the insurance industry that you should be aware of and leverage.

Ready to learn what these tech trends are?

Let’s get started.

1. Applied Artificial Intelligence

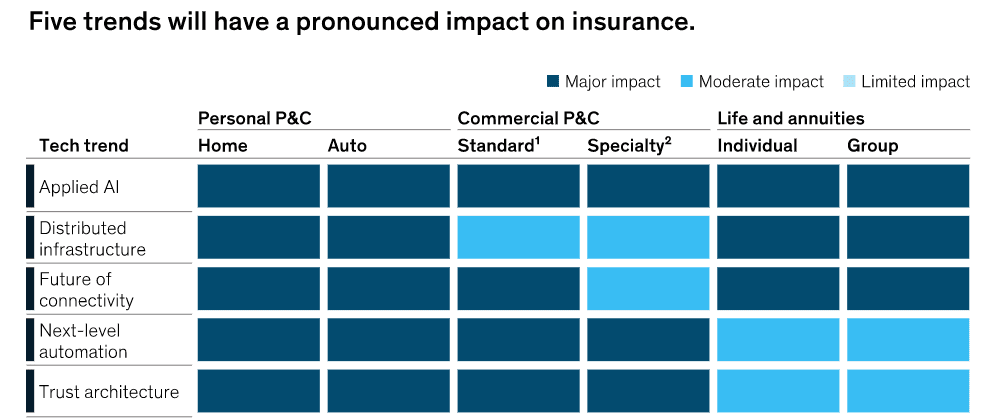

According to a report by McKinsey, applied AI is one of the top trends for the insurance industry with industrywide applications.

Image via McKinsey

AI is bound to disrupt the core insurance process across the enterprise. Using AI you can use massive amounts of customer data, which is already available to most insurance companies, to create personalized experiences.

For example, AI influencers are reducing the cost of influencer marketing and you can select influencers as per your need and connect with their creators for deals.

You can also optimize the turnaround cycles for claims and the underwriting process with the use of AI.

2. Predictive Analytics

This is one of the tech trends for the insurance industry that will grow further with the growing adoption of AI technology.

With the help of AI, insurance companies can boost their data analytics capabilities to leverage predive analytics.

Some applications of predictive analytics in the insurance industry are:

- Identifying risky customers

- Determining the right prices

- Anticipating fraud risks

- Predicting future trends

- Triaging claims

- And more!

Given its multiple applications, the use of predictive analytics will grow exponentially, making it one of the top trends for the insurance industry.

3. Future of Connectivity – IoT

The growing adoption of IoT will usher in the new era of widespread connectivity, making it one of the top trends for the insurance industry.

This trend will manifest in the form of increased data sharing through technologies like smart homes, wearables, automobile sensors, and more.

More data will enable insurance companies to optimize risk assessment, pricing, and a lot of other aspects. Data from wearables will help car insurance providers, automobile sensors will help car insurance providers, and so on.

4. Automation

One of the biggest trends for the insurance industry in recent years has been the rise of process automation powered by AI and machine learning.

At this point in 2023, almost every insurance CRM has some type of automation technology.

One key necessity for this trend, though, is to go digital and store all data and documents online, so that machine learning algorithms can analyze these and automate many processes.

This will require you to move your documents from offline tools like Word to Google Docs or any other online tools. Also, physical documentation would need to be completely weeded out.

You will also need to adopt complementary technologies like e-sign generators, cloud storage, and more to go digital and completely adopt this trend.

5. Insurtech

One of the recent tech trends for the insurance industry is the rise of insurtech firms. These are companies that leverage tech to reduce costs for both the consumers and insurance companies.

If there’s one place where the tech trends for the insurance industry are widely adopted, it is insurtech companies. That is why more and more insurance providers will collaborate with insurtech companies to gain operational excellence and cost savings.

6. Cloud Technology

The move to the cloud is not new, yet it is one of the top trends for the insurance industry as cloud adoption is growing at an unprecedented pace.

The use of on-premise legacy processes only weights down the insurance industry’s core processes. Shifting to cloud infrastructure, therefore, is intuitive and necessary to add flexibility and reduce costs.

Cloud technology is also crucial for other complementary tech trends like automation and predictive analytics. After all, you can only improve your computing and analytics if you have data online and cloud storage enables that.

7. Chatbots

Chatbots are one of the biggest tech trends not just for the insurance industry but across industries.

Why?

Mainly because they can help companies provide 24/7 customer support and save employees’ time to focus on more critical tasks.

Specifically in the insurance industry, chatbots can help customers find the right policy, understand the claims process, and more. They can also track customer service requests and provide support instantly, thus improving customer experiences.

Chatbots don’t just help with customer service, but can also be used to drive sales. When a prospect visits your website, chatbots can interact with them and help them find the right product or policy.

They can also guide them through the policy details and provide the option to make a purchase. This gives an entirely new meaning to the concept of real-time shopping, as it does not even require any human intervention.

Ready to Adopt the Top Tech Trends for the Insurance Industry?

These are some of the biggest tech trends for the insurance industry in recent years. Most of these tech trends have the potential to completely disrupt the current landscape and reshape the insurance industry.

If you have not yet leveraged these tech trends for the insurance industry, it’s time that you do that. Start with some of the simpler ones like chatbots or adopting cloud technology, and then make your way upwards.

Which of these tech trends for the insurance industry will you adopt first? Share your responses in the comments section.