Publisher Channel Content by GetApp.com

If the term “accounting software” doesn’t immediately excite you, it’s perfectly understandable. Luckily, cloud-based accounting apps are breathing new life into doing business in the digital space.

Once upon a time, you had to make a trip to the local “big box” retailer to pick up an accounting application. Thankfully, that’s no longer the case because it’s all in the cloud.

Off-the-shelf accounting applications are quickly going the way of the dodo. They are readily being replaced by software-as-a-service (SaaS) providers, which use the power of cloud computing to provide easily accessible accounting tools with on-demand consistency. What’s more, financial reporting apps offer the benefit of automatically updating with click-free ease.

If you’ve been using a legacy accounting application, or worse, an Excel spreadsheet, to manage your finances, it’s time to consider switching your financial reporting to a cloud-based app. Here are five accounting applications with free trials:

- FinancialForce Accounting App for Salesforce

- FreshBooks Cloud Accounting Solution

- Zoho Books Online Accounting Software

- Netsuite OneWorld Cloud Accounting and ERP

- FreeAgent Online Accounting Application

So what’s stopping you from putting your financial reporting in the cloud? Is it concerns over migration? Security? Ease of use?

Whatever the case may be, here’s a this list of five reasons to make the switch and help you make a seamless transition to a cloud accounting app:

1. More intuitive

The current generation of cloud-based accounting apps have the features of legacy, desktop applications.

Case in point: FinancialForce. FinancialForce sports an intuitive, feature-rich interface that provides a familiar desktop functionality. FinancialForce also has Salesforce support, real-time reporting, and multi-dimensional analysis presented in a single-screen interface.

Those old Excel spreadsheets, time-tested though they may be, just can’t compare to the ease of use of FinancialForce.

Those old Excel spreadsheets, time-tested though they may be, just can’t compare to the ease of use of accounting apps like FinancialForce.

2. No micromanagement

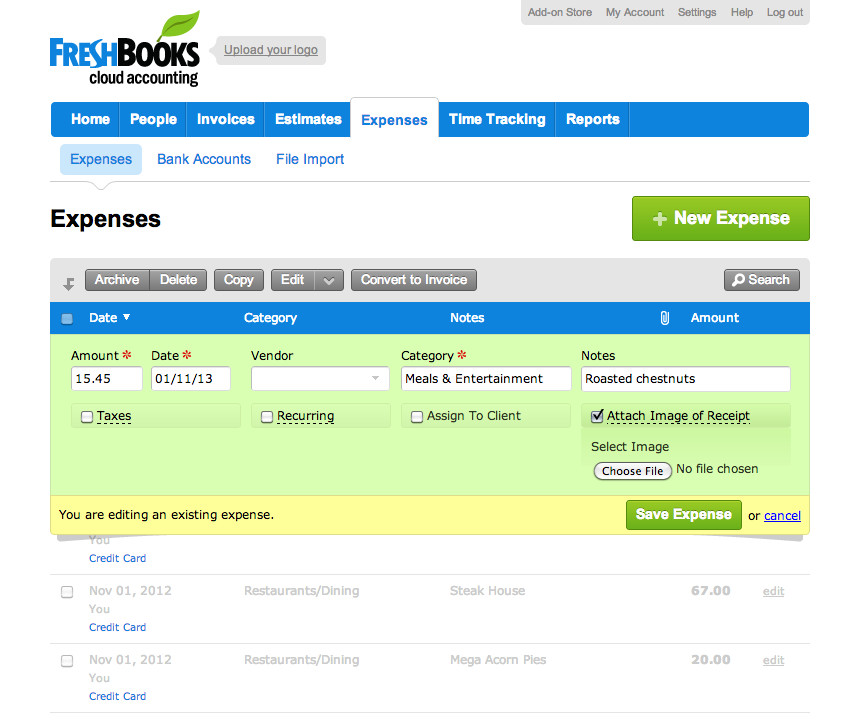

As cloud apps become more intuitive, they also require less micromanagement. FreshBooks is an example of one of the many cloud accounting apps that do the heavy lifting.

FreshBooks is nowhere near as bogged-down as legacy applications and complicated (always broken) spreadsheets. It has simplified time-tracking and invoicing, as well as expense tracking and financial reporting, packaged together in a unified interface.

Even without reading the help guide, you can get started with it from day one; it’s a testament to just how far cloud accounting apps have come compared with the steep learning curve of older applications (remember that feeling the first time you used Excel?).

3. They grow with your business

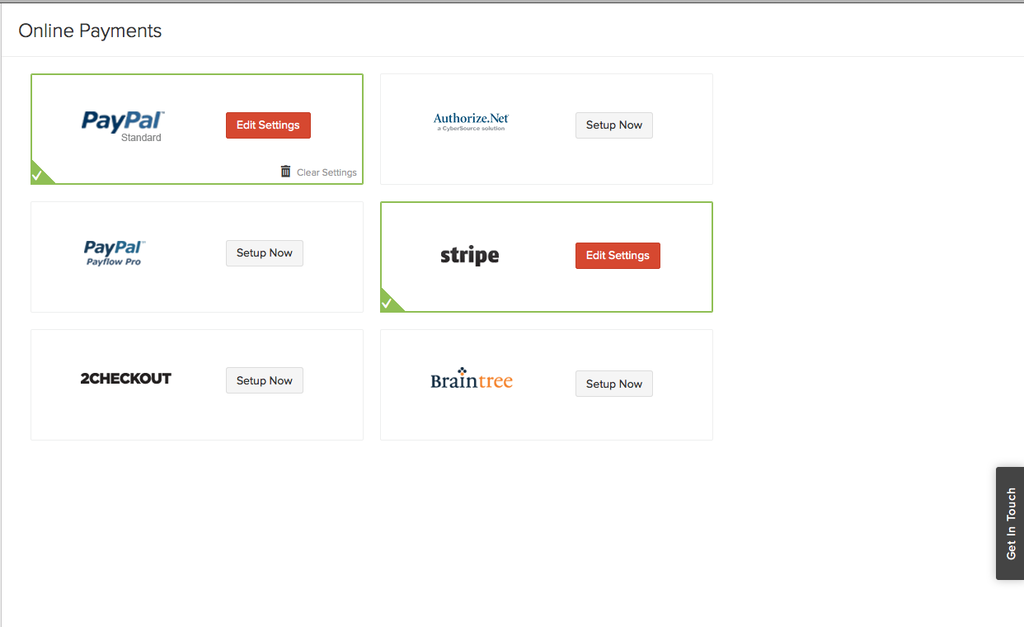

Zoho Books is an example of a scalable accounting app. In it you’ll find integrated (and easy) invoicing, online payment platform integration, time and expense tracking, and totally free support. If you’re already using another Zoho product, you’ll also find it easy to access contacts and share data interchangeably with Zoho Books.

While Zoho Books is the standout offering for SMBs and freelancers, larger enterprises with team members distributed around the world will find similar features in many of the accounting apps currently on the market. As always, some comparison shopping is advisable.

4. Work on an international scale

Because accounting regulations vary from one locale to the next, accounting apps work with different currencies, languages, and rules. Some apps, like NetSuite OneWorld, can factor in international tax jurisdictions for more than 190 countries, making financial reporting a snap come tax season.

If your business is a large organization with a global reach, you really owe it to yourself to compare the accounting apps currently on the market side-by-side.

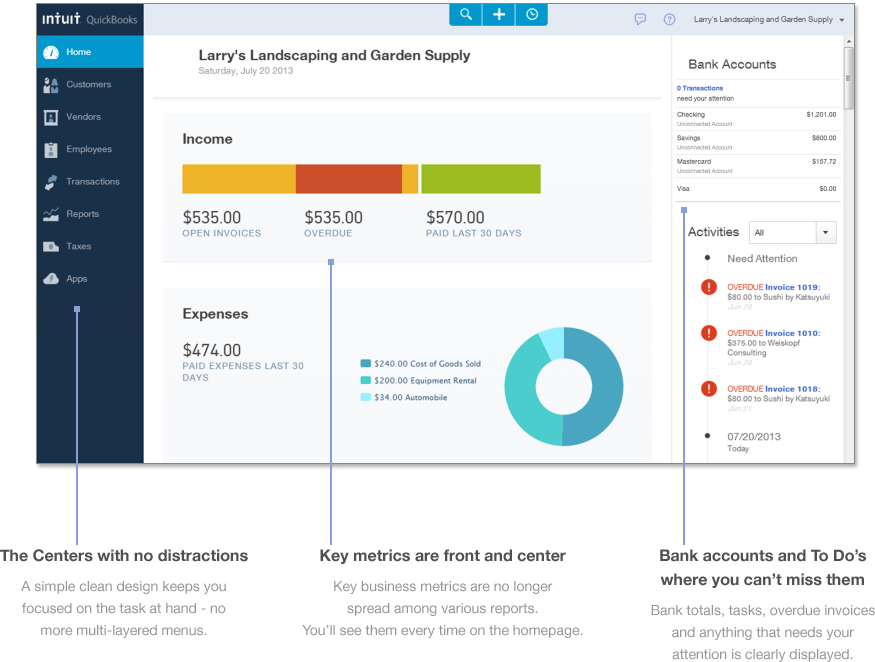

5. The QuickBooks switch is simple

If you are among the many users of Intuit’s QuickBooks, you’ll be happy to know that the company now offers QuickBooks Online, a cloud-based version of its esteemed financial reporting software.

QuickBooks Online makes it easy to send invoices, accept payments, track expenses, and even conduct payroll services inside your browser or on your mobile device.

Are you ready to make a seamless transition to an accounting app? Which one do YOU recommend?

Still interested? Check out GetApp’s comprehensive list of accounting apps.

______________________________________________________________________________

Tweak Your Biz is a thought leader global publication and online business community. Today, it is part of the Small Biz Trends stable of websites and receives over 300,000 unique views per month. Would you like to write for us?

An outstanding title can increase tweets, Facebook Likes, and visitor traffic by 50% or more. Generate great titles for your articles and blog posts with the Tweak Your Biz Title Generator.