Welcome to the future of financial software development! If you’re here, we’re guessing you’re curious about how this dynamic and complex field has evolved in the past few years.

As 2023 marches on, financial software development remains critical to the success of any investment firm or bank.

But fear not, dear reader, for you have stumbled upon the expertise of someone who can help guide you through this maze of zeros and ones.

As an experienced financial software developer, I’m here to guide you through the wonderful world of financial software engineering. From software optimization to agile methodologies, I’ll show you how financial software development works in 2023.

Whether you’re a seasoned financial professional or just starting out, let’s explore this brave new world together!

What is Financial Software Development?

The primary goal of financial software development is to streamline financial processes and increase employees’ productivity, which has revolutionized how businesses operate.

Companies across the globe are embracing the integration of technology into their financial processes through the help of AI, ML, and big data.

Fintech covers a broad range of services, including:

- Mobile banking & payments

- Automated financial advisors

- Investment tracking and portfolio management tools

- Tax filing software

- Digital money transfers

- Blockchain technology for secure transactions

- Machine learning algorithms to detect fraud and malicious activity

- Robo-advisory services for real estate investments

Due to its versatility, the fintech industry caters to a wide spectrum of clients, including international payment systems, brokers, crypto traders, and foreign cryptocurrency exchanges.

Given the dynamic nature of the market, each technological breakthrough can steer the industry in a new direction, making it exciting and ever-evolving.

What Does a Financial Software Developer Do?

The role of a financial software developer is to optimize software development efficiency for the financial industry.

Optimizing efficient software development for financial sector is crucial for ensuring that financial organizations can stay competitive in today’s fast-paced business environment.

Fintech developers work on a range of features that ensure these organizations can compete in an ever-changing business environment.

To streamline software, it is crucial that developers:

- Implement best practices and strategies emphasizing speed, security, and collaboration.

- Adopt agile methodologies, automation tools, and collaboration platforms to deliver high-quality software solutions that meet the needs of their clients and customers.

By working on these features, developers contribute to the success of the finance industry and drive innovation forward.

What Features of Development Does a Financial Software Developer Work On?

Now that you have a better understanding of the role of a financial software developer, let’s dive deeper and examine the features they prioritize when working on financial software development.

Security

In today’s age of data breaches and cyber-attacks, the importance of security cannot be overstated.

Whether it’s protecting user data from unauthorized access or preventing fraudulent activity such as money laundering, security features are integral to any financial software.

A financial software developer must be well-versed in various security measures, including:

- encryption

- multi-factor authentication

- and firewalls

By implementing strong security measures, financial software can create a secure environment for users to conduct their financial transactions with peace of mind.

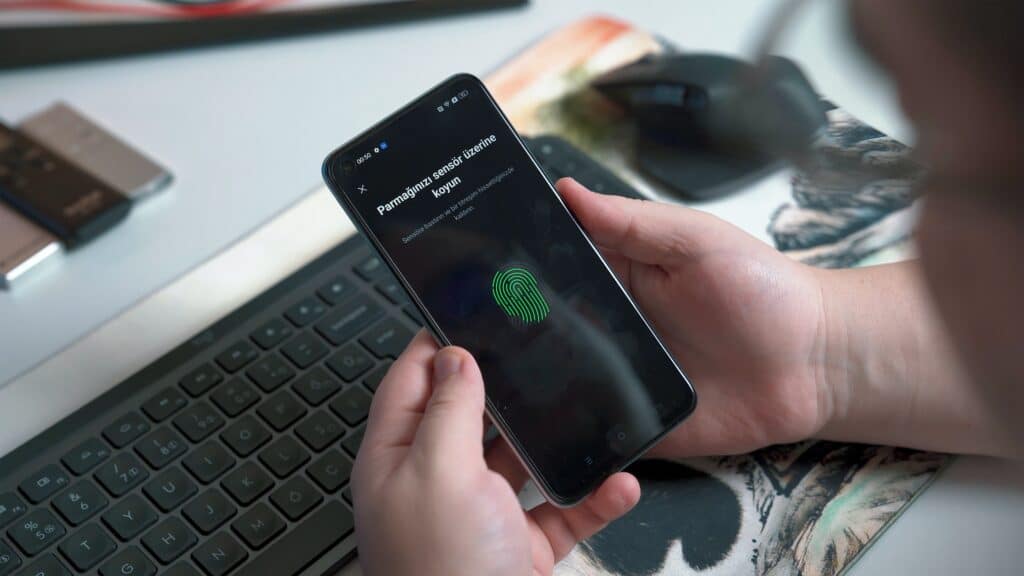

Verification

In addition to security, verification is an important feature of financial software development.

Verification ensures the proper authentication of every transaction; only valid users can conduct transactions.

This prevents malicious actors from exploiting financial systems for their gain and adds an extra layer of protection on top of the security features already in place.

To ensure accuracy and trustworthiness, financial software developers must develop robust verification methods that can effectively detect suspicious activity, such as bots or automated scripts.

By working on features like security and verification, financial software developers play an important role in keeping the finance industry safe and secure.

Dashboards (With Payment)

Financial software developers work on many features to ensure businesses can closely monitor their finances.

One particularly important feature is dashboards, which provide an overview of payment information in an intuitive, easy-to-read way.

With the right dashboard, businesses can:

- Make more informed decisions

- Identify trends over time

- Streamline their financial operations

- Track payments more effectively

- Identify late payments

- And stay on top of their cash flow.

For financial software developers, building a great dashboard is all about finding the right balance between functionality, user experience, and visual appeal.

By working with businesses to understand their unique needs, developers can create tailored dashboards that help to drive business success.

Integrations

Financial software developers must design integrations that work seamlessly with various accounting and financial systems, such as QuickBooks or Xero.

Integrations enable seamless communication between software applications, allowing efficient and streamlined workflows.

These integrations ensure accurate and transparent data transfer, enabling users to make informed decisions based on real-time information.

The complexity of integrations requires developers to deeply understand various programming languages, APIs, and database management systems.

Push Notifications

Push notifications have revolutionized the way users interact with financial software.

They allow developers to keep their clients informed with real-time updates and alerts, ensuring they never miss critical information.

A few of the many ways push notifications play an important role in fintech include:

- Transaction updates – Get notified when a transaction is completed or pending.

- Account balance alerts – Receive notifications when your account balance reaches a certain threshold.

- Security alerts – Stay on top of any suspicious activity on your account with instant security alerts.

- Bill reminders – Never miss a payment again with push notifications reminding you of upcoming bills.

- Investment updates – Keep track of your investments with instant alerts on stock prices and portfolio changes.

Push notifications make financial software user-friendly and intuitive, allowing users to stay up-to-date with the latest developments in their financial life.

Financial Software Development Vs. Software Development

While the two share many similarities, some key differences exist between financial and regular software development.

Financial software development is a specialized field that requires an understanding of business and financial operations.

- Financial developers must understand the unique requirements of the finance industry, such as compliance with various regulations and adhere to the highest security standards.

- Financial developers must also be knowledgeable in various programming languages and have experience dealing with complex integrations, ensuring accurate and secure data transfer.

General software development focuses on developing features; rather than financial operations. General developers create applications, websites, and software tools, while financial developers create applications and software specifically designed to address the needs of finance professionals.

Overall, financial software development requires a greater level of specialization, skill, and knowledge than general software development.

To stay competitive in this field, developers must keep up-to-date with the latest trends and regulations within the finance industry.

Types of Financial Software Development

Financial software development covers a wide range of disciplines, from creating custom-made banking applications to developing integrations with existing financial systems.

Each type of development requires its own set of tools and techniques to ensure efficient and secure operations.

Next, let’s look at some of the most popular types of financial software development.

Online Banking

In today’s tech-savvy world, online banking is rapidly replacing traditional banking methods.

With just a few clicks of a button, you can:

- Transfer money

- Pay bills

- And even manage investments from the comfort of your home.

But behind the scenes, a complex financial software development system makes it all possible.

Online banking software must be reliable and secure, handling sensitive information and ensuring quick and accurate transactions.

Blockchain and Crypto

The rise of blockchain and cryptocurrency technologies has revolutionized the financial industry.

Developers must now create innovative solutions for digital assets, leveraging smart contracts, digital wallets, and more.

From trading platforms to payment systems, these developers must understand the intricate details of this new technology to create secure and efficient solutions.

Digital Wallets

Digital wallets are becoming increasingly popular, providing an easy and secure way to store money.

Developers must build these solutions with strict security protocols, such as multi-factor authentication and end-to-end encryption.

These wallets must also integrate with existing financial systems, allowing users to easily manage their finances.

Digital Brokerage

Digital brokerages disrupt the financial industry, allowing users to trade stocks and other assets with just a few clicks.

Developers must create robust trading platforms that provide real-time stock price and portfolio updates. They must also ensure user security through advanced authentication measures and data encryption.

Financial software developers must understand the technical and financial aspects of creating these solutions to remain competitive in this ever-evolving field.

B2B Fintech

Business-To-Business (B2B) financial technology is a rapidly growing sector that allows companies to automate their financial operations.

Developers must create tailored solutions for each unique client, leveraging the latest technologies such as cloud computing, artificial intelligence, and machine learning.

These solutions must also be secure and reliable, ensuring accurate and secure data transfer.

Big Data Analysis

In the world of finance and investment management, data is king.

That’s why big data analysis is critical to financial software development. Companies use this technology to sift through massive amounts of financial data, looking for patterns, insights, and opportunities they might otherwise miss.

Whether analyzing market trends, predicting consumer behavior, or identifying potential risks and opportunities, big data analysis is essential in helping financial professionals make informed decisions.

By leveraging this software, businesses can gain a competitive advantage by spotting trends and making smart investments, setting themselves up for success in the fast-paced world of finance.

Custom Online Platforms

Custom online platforms are increasingly popular for businesses looking to manage their accounts and investments.

These systems must be tailored to the company’s specific needs, providing reliable access to financial data and the ability to conduct secure transactions.

Developers must also ensure integration with existing bank accounts, allowing quick and easy fund transfers.

What are the Stages of Fintech Development?

Financial software development is a complex process requiring developers to combine their technical and financial expertise.

The stages of fintech development vary depending on the project, but they generally follow this sequence:

- Gathering requirements

- Designing the solution

- Developing and testing the code

- And deploying it in production.

Let’s examine these stages in closer detail.

Gathering Business Needs

The fintech world is rapidly evolving, and before developing a successful application, developers must first gather business needs.

Fintech developers must carefully analyze the market and create a detailed execution plan.

By focusing on a specific product, such as a trading platform or personal finance management service, developers can determine the best strategies for success in a crowded field.

Prototyping

At this stage, the development team works tirelessly to bring a product concept to life.

The team must balance functionality and accessibility, creating an interface that all can easily understand, regardless of their experience level.

Design

Design is an integral part of fintech development that lays the foundation of a user-friendly application.

At this stage, designers spend countless hours creating and incorporating the perfect interface elements into your app’s approved visual style and developing the service navigation.

This groundwork ensures your customers have the best experience possible using your application.

Coding

The coding stage is where the magic happens. It’s where the vision becomes a reality, and the fintech product begins to take shape.

During this period, the team decides on the appropriate tech stack to deliver the best Fintech product.

Choosing the right coding language, framework, and environment can mean the difference between a breakthrough application and a flop.

Testing

During this phase, QA engineers meticulously analyze each aspect of the software, ensuring it complies with the design and technical specifications.

TDevelopers delve into the nitty-gritty details of the project, preparing test documentation and conducting both manual and automated testing.

By doing so, they can rapidly identify and address bugs or issues before launching the software.

This rigorous testing phase ensures that fintech products are of the highest quality, delivering an efficient and robust end-user experience.

Deployment

Once the team has tested the product and deemed it ready for the public, it goes to the client for deployment.

But the fintech developer’s involvement doesn’t end there.

Developers must continue providing uninterrupted support and promptly fix any bugs that arise.

This involvement ensures the end product meets industry standards and client expectations.

What Tech Stack Do Fintech Developers Use?

A tech stack combines programming languages, frameworks, libraries, and other components used to build a digital product. It’s composed of both front-end and back-end elements.

Now that we’ve discussed the stages of fintech software development let’s look at the technology stacks they use to create these applications.

SDKs

Software Development Kits (SDKs) provide tools, libraries, and programs that enable developers to create applications most efficiently.

Popular SDK examples include:

- Apple’s Cocoa Touch

- Facebook’s React Native

- Google’s Flutter

- and Microsoft’s .NET.

Programming

Choosing the right programming language is a crucial step in fintech development.

For example:

Java and Python are great for Android app development, while Objective-C or Swift is best for developing iOS applications.

In addition, developers also use:

- C/C++

- JavaScript

- HTML5

- CSS3

- PHP

- And Ruby on Rails to create fintech products.

Cloud-Based Technologies

Cloud technologies are essential for fintech software development.

Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are some of the most popular cloud-based services fintech developers use.

These platforms provide comprehensive features to power applications with powerful computing tools, storage solutions, machine learning capabilities, and more.

Databases

Fintech developers rely on databases to store and manage data efficiently.

Popular database solutions include:

- MongoDB

- MySQL

- Oracle Database

- PostgreSQL

- and Microsoft SQL Server.

These databases enable the team to quickly retrieve and manipulate information in their applications.

Wrap Up

Financial software development has come a long way in the last decade and will become more sophisticated as technology advances.

By understanding the different types of development and staying up-to-date on industry trends, you can ensure you always meet your financial needs.

With the help of financial software developers, you can create secure and reliable fintech solutions that fulfill your needs.

What are your thoughts? How do you think Financial Software Development will evolve in the coming years? Let us know in the comments!