Living below your means is an unattainable goal for many. While you’re scrambling to pay bills and still manage take-out every other day, we hope this pops up on your feed as a guide. Interestingly, schools teach you everything from algebra to perpendiculars, but miss out on the valuable lesson of saving money!

If you’re tired of ending every month with absolutely no clue as to where your hard-earned money goes, it might be time to re-evaluate your living expenses. While many articles tell you complicated drills, we aim to provide practical tips on how to save money for life after college.

Distinguish Between Wants and Needs

Sounds easy? Try it yourself. Unfortunately, living over your means has become a standard of living in America. Among burgeoning expenses, it is no surprise why many fresh graduates struggle to manage their budgets.

Let’s take a quick overview of the expenditure of an average American household in order of highest to lowest.

- Housing

- Transport

- Food

- Healthcare

- Entertainment

- Miscellaneous

Now you might think that food is obviously a ‘need.’ While that is true, most people tend to rely on eating out at least thrice a week. Is that a necessity? Similarly, everyone wants to spend on entertainment, but going overboard and crossing the line between a want and need is where the problem lies.

How to Live Below Your Means?

A great way to sort this out is by preparing for the worst. List down all the things you can cut back on. This might include getting rid of the pricier internet connection, sharing accommodation with flatmates, or house hacking. After all, do you really need a three-bedroom flat all to yourself?

Another way you could force yourself into this habit is by depositing half of your paycheck into savings. This will make you realize how much over-spending you do when you have cash at hand.

Switch to Home-Cooked Meals

This comes as a dreaded thought to most graduates, but the following statistics will definitely change your mind. Dining out is no doubt hassle-free, but just as expensive. Did you really think that freshly cooked pasta with parmesan shavings served hot to you would come without a price?

The average American household spends an average of $3000 on dining in a year. Let that sink in. Before you conveniently detach yourself from ‘household,’ let us inform you that one person’s spending counts as household too.

The problem is that when we’re buying food each day, we don’t realize that those minor $10 per meal expenses sum up to a considerable amount by the end of the month and year.

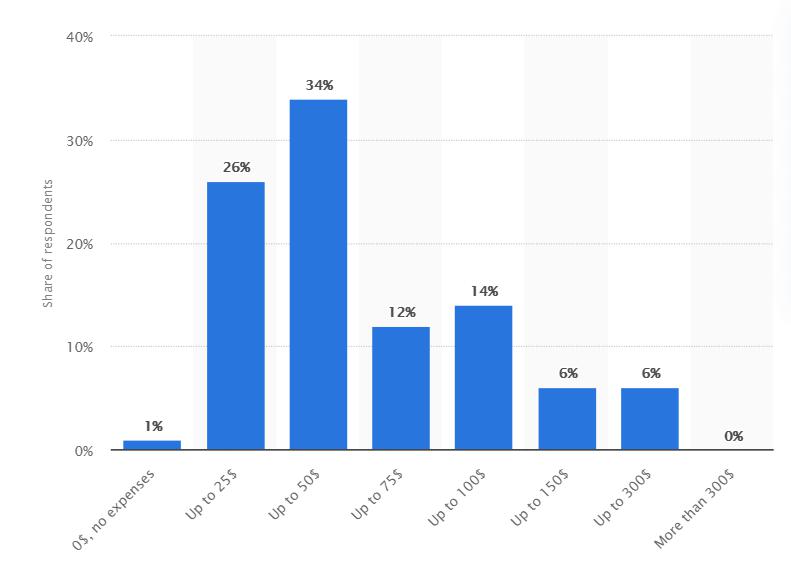

Average Spending on Food Ordered Online

The graph gives an insight into the average spending on food when ordering online. The highest number of respondents stated $50, which would amount to $600 a month for eating out just three times a week. Can you imagine how easily you can manage expenses within your salary if you prepare meals at home?

How Much Can You Save?

An average commercial meal costs around $13. Even if you order from a cheaper place, the frequency with which your order will amount to the same number. In contrast, an average meal prepared at home would cost approximately $4. This means you will end up saving roughly $9 per meal!

Saving Money on Grocery Shopping

Now that we have established home-cooked meals are cheaper, here are some grocery saving tips for all novices.

- Always go prepared with a list of things to buy so you avoid shopping for unnecessary items and stick to the list.

- Buy in bulk so you can get lucrative deals.

- However, don’t buy things you don’t need, as throwing away groceries is the same as chucking away money.

- Choose non-canned goods as fresh produce is cheaper.

- Avoid buying microwave dinners as they cost more than healthier, home-cooked meals.

- Always scan the entire shelf and not just the goods that are kept at eye-level, as they tend to be pricier.

- Buy at the same grocery store so you can be eligible for loyalty cards and rewards.

You may be no Gordon Ramsay, but following a recipe online, and cooking regularly will perfect even the most amateur cook!

Save Money on Transport

Owning and maintaining a car can take a significant chunk from your income. A more viable alternative would be shifting to public transport instead of driving around. If you live in a city, you would be able to find many options for public transportation.

Even if you reside in the countryside, you will get many commuter rail or bus options. You can also look for alternatives like Uber or Lyft and see how this works out for you. Fuel is a direct cost incurred for consumers. Gasoline and motor oil accounted for 27.2% of the average household’s spending on transport.

A rough estimate shows you can save $10,000 a year on car payments, parking tickets, insurance, repairs, and fuel.

Alternatives

People right out of college are still young and can get their daily dose of exercise by walking or cycling. Even older people would benefit greatly from some physical activity. You can walk to your nearest public transport system and save significant amounts of money every month.

Debit Cards Over Credit Cards

Many Americans struggle with short-term savings. After careful consideration, we concluded that debit cards are a better option for saving money than credit cards. Here are a few reasons why this is.

Spending Power

We’re all guilty of going overboard when there is no limit to how much we can spend. Debit cards restrict you to the amount in your account, whereas credit cards allow you to spend up to your (skyrocketing) credit limit. This negates the whole concept of living under your means!

Debt

If you opt-out of overdraft protection, you don’t need to worry about debt with debit cards. However, if you’re unable to pay the complete balance for your credit card after each month, you can incur debt with an average interest rate of 16.14%. The more it prolongs, the more debt you’re facing.

Hence, for people who are unable to manage their savings, it’s time to get rid of your credit cards in favor of debit cards.

Managing your budget is not that hard. Once you start planning your budget and assessing what you really need, you can live below your means. All it needs is switching to more affordable alternatives and practicing restraint. We hope these tips can help get you started on the art of saving money like a pro!

DepositPhotos – Money Path