Wouldn’t you love to take control of your loans?

Maybe life got on top of you – a medical emergency, or a housing crisis – and you just lost track of your debts.

And now you’re overwhelmed by all the payments you’re supposed to make and you can’t keep up with them all.

Don’t worry – we’re not here to judge. It’s happened to the best of us.

If you’ve heard about debt consolidation, it might sound too good to be true.

But the fear of damaging your credit score could be holding you back.

If you’re wondering what impact debt consolidation could have on your score – we’ve got you covered.

Here’s everything you need to know about debt consolidation, and what it can (and can’t) do for your credit score…

What Is Debt Consolidation?

Debt consolidation just means that you combine all your existing loans into one loan (ideally one with a lower payment and interest rate!)

This is generally done by using the new loan to pay off all the old ones – making it easier to keep up with your payments and stay on track.

There are a few ways you can consolidate debt, including:

Personal Loans

(An unsecured loan that can offer you competitive interest rates)

Credit Card Balance Transfers

(Moving existing balances to a new credit card account – often one with 0% interest)

Debt Consolidation Loans

(A loan specifically designed to help you combine all your debts into one)

Home Equity Loans

(Remortgaging your home as a secured loan to pay off current debts)

For many, debt consolidation is an easy way to simplify loans and lower interest rates – but it isn’t without risk.

That’s why it’s so important to weigh up the pros and cons before committing to a consolidation loan.

Can Debt Consolidation Raise My Credit Score?

Yes, and no.

It depends on how you do it.

Debt consolidation, when done right, can raise your score by diversifying your credit mix, helping you meet payments and lowering your credit utilization (which is the biggest point scorer on your credit score.)

What are the Advantages of Debt Consolidation?

You Can Lower Your Interest Rate

Arguably the biggest benefit of debt consolidation is being able to lower your interest rate.

If you have, for example, 5 credit cards to pay off, with an average of a 15% interest rate, and you can consolidate that through a personal loan to give you an interest rate of 5%, your payments and debt become far more manageable.

Some bank transfers could even give you an interest rate as low as 0%, placing you in a far better position to pay off your debt, at your own pace, and get your other finances back on track

You Can Simplify Your Debts

Another huge benefit of debt consolidation is only having to worry about one loan.

You no longer have to worry about keeping up with all your different payments (and it’s much harder to miss a payment if you only have one to make!)

With just one loan to manage, it’s a lot easier to build a repayment plan around this and to avoid missing deadlines and damaging your credit score.

You Can Protect Your Current Credit Score

If you’re overwhelmed by loans, consolidating your debt helps you avoid other avenues, like bankruptcy or settlements, which could be catastrophic to your credit score.

Even debt management plans will be registered on your report and can stop you from taking out any other loans or making financial plans.

Debt consolidation can protect your credit score from taking a huge hit, or prevent you from accruing damaging notes in your financial records.

You Can Get a Fixed Payoff

When consolidating your loans, you could be able to opt for a fixed payoff.

This means that you’ll have a fixed time to pay off your loan, and you’ll be paying the same amount each time.

This gives you more control and stability over your payments, and it’s especially beneficial if you didn’t have a fixed pay-off on your previous debts.

Debt Consolidation might seem like a perfect solution, but there are some ways it can negatively impact your finances, and especially, your credit score.

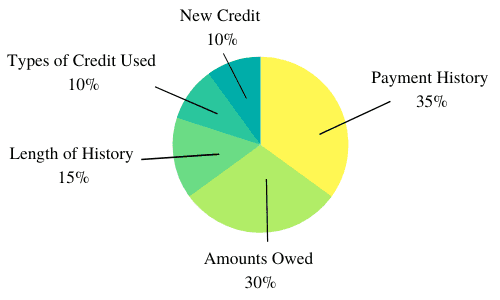

How is Your Credit Score Determined?

How Can Debt Consolidation Lower My Credit Score?

Taking out a new loan to use for consolidation can lower the average age of your credit history, as well as requiring a hard credit search – both of which can lower your score.

Depending on the loan you take out, you might increase your credit utilization, which can also impact your score – that’s why it’s so important to get a good deal when looking for a consolidation loan.

Disadvantages of Debt Consolidation

You Could End up Paying More in Interest and in Rates

Although debt consolidation might simplify things, if you have to pay a higher interest rate or you put yourself even further in debt, it’s just not worth it.

Be aware that many ‘low interest rates’ are actually introductory deals that are subject to change.

You Could Lose Anything You Put up for Security

If you choose a secured consolidation loan (which is likely as it’s much easier to get approved for) you run the risk of losing any collateral you put down.

You could lose your car, or even your home – which is why it’s so important to weigh up all the options before choosing a secured loan.

You Might Have To Pay Extra Fees

If you consolidate through a balance transfer, or through a debt management program, it’s likely there will be service or transfer fees to pay.

You might have to commit to monthly payments that really add up – so make sure you’re not losing money in the long run when considering your loan.

What Kind of Debts Can I Consolidate?

You can consolidate really any type of debt – but that doesn’t mean you should.

The kinds of debts you might want to consolidate include:

But you might just want to consolidate a selection of your debts.

For example, if your student debt has a low-interest rate of 6%, and your consolidation interest rate is 7%, it might be better for you to leave your student debt out of your consolidation plan.

There’s never a one size fits all with debt consolidation – that’s why you need to take your time and plan around your specific circumstances to make it work for you.

What Are the Best Ways To Consolidate Debt?

Get in the Right Mindset and Create a Budget

If your goal is true to pay off all your debts, you need to make sure you are prepared and ready to achieve that before you consolidate your debts.

You don’t want to consolidate your debts, only to realize you’re making the same mistakes through lack of preparation and bad financial planning.

Create a budget for how much you can afford to pay back every month, and look for a consolidation plan that works within that budget.

Look for a Credit Card With a 0% Interest Rate and a 0% Balance Transfer Fee

The main goal of consolidating debt is to lower your interest rates and to pay less, not more.

It might make paying off debts easier, but if you consolidate to a loan with a high-interest rate, or you have to pay a really high transfer fee to move your debts, you’re making things worse for yourself.

If you’re planning on using a bank transfer for debt consolidation, make sure that you shop around for the best deal before you commit to anything.

Look Into Debt Consolidation Loan Options (i.e. a Personal Loan)

A debt consolidation loan could be a great option – you don’t have to secure it using any property or assets, so the risk is less than with, say, a second mortgage.

(An unsecured loan might also be a better option if you’re already struggling with finances – securing a loan with something like your house is just too much of a risk!)

You might even want to talk to a debt consolidation company to see what options they can offer you – but make sure they’re credible and legitimate!

Always look for something that offers good terms and low-interest rates – that’s the key to success here.

Trying to get control of your finances – especially when you’re in debt – is scary.

But if you’re ready, to be honest about your spending, build a long-term plan and commit to a goal, you can set your finances straight without damaging your credit score.

Disclaimer – The information in this article is purely educational. It is no substitute for actual financial advice and if you are having monetary problems you should consult a professional.

Woman with credit card and a phone -DepositPhotos