The cryptocurrency landscape in 2025 presents unprecedented opportunities for perpetual traders, particularly in Bitcoin (BTC) and Ethereum (ETH) markets. With institutional adoption reaching new heights and regulatory frameworks becoming clearer, high-leverage trading strategies have evolved into sophisticated tools for capturing market movements. This comprehensive playbook explores advanced techniques, risk management protocols, and strategic approaches for maximizing returns while navigating the volatile crypto environment.

Understanding the 2025 Market Dynamics

The crypto market in 2025 operates in a fundamentally different environment compared to previous years. Bitcoin has solidified its position as digital gold, while Ethereum continues to evolve as the backbone of decentralized finance. Market volatility, while still present, has become more predictable with institutional participation and improved market infrastructure. These changes create unique opportunities for perpetual traders who understand how to leverage market mechanics effectively.

Perpetual contracts have become the preferred instrument for sophisticated traders due to their flexibility and capital efficiency. Unlike traditional futures, perpetual contracts don’t have expiration dates, allowing traders to maintain positions indefinitely while benefiting from funding rate mechanisms that keep prices anchored to spot markets.

High-Leverage Strategy Framework

Momentum-Based Breakout Strategy

For BTC and ETH perpetual trading, momentum-based breakout strategies prove highly effective when combined with proper leverage management. This approach involves identifying key resistance and support levels, then using leverage to amplify gains when price breaks through these critical zones. The key is timing entry points during periods of high volume and clear directional bias.

Range Trading with Dynamic Hedging

Range trading strategies work exceptionally well in sideways markets, which historically occur 60-70% of the time in crypto markets. This approach involves selling resistance and buying support levels while using moderate leverage (5x-20x) to enhance returns. The strategy becomes particularly powerful when combined with dynamic hedging techniques.

Dynamic hedging involves opening opposing positions in related assets or using different contract types to reduce overall portfolio risk.

Advanced Risk Management Techniques

Position Sizing and Leverage Laddering

Effective position sizing represents the cornerstone of successful high-leverage trading. The optimal approach involves using a percentage-based system where position size correlates inversely with leverage. Higher leverage positions should represent smaller percentages of total capital, while lower leverage positions can comprise larger allocations.

Leverage laddering involves gradually increasing position sizes as trades move in your favor, rather than opening full positions immediately. This technique allows traders to capture larger moves while limiting initial risk exposure.

Stop-Loss Strategies for High-Leverage Environments

Traditional stop-loss orders often prove inadequate in high-leverage perpetual trading due to price gaps and liquidation risks. Advanced traders employ multiple protective mechanisms, including time-based stops, volatility-adjusted stops, and partial position closures at predetermined profit levels.

Time-based stops involve closing positions after a specific duration if they haven’t reached profit targets, preventing overnight gap risks. Volatility-adjusted stops use recent price movements to determine appropriate stop distances, ensuring stops aren’t triggered by normal market fluctuations while still providing protection against significant adverse moves.

Platform Selection and Execution

Choosing the Right Trading Platform

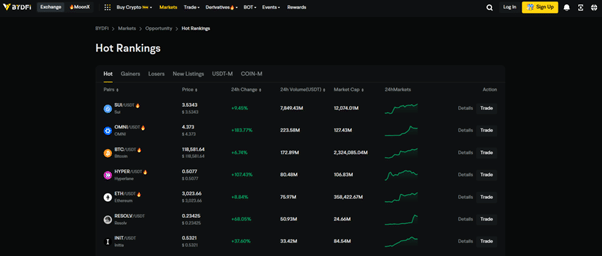

Selecting an appropriate trading platform significantly impacts success in high-leverage perpetual trading. Key considerations include available leverage levels, fee structures, order execution speed, and risk management tools. Trading BTC & ETH requires platforms like BYDFi that offer copy trading capability, competitive trading thresholds as low as $10, and robust infrastructure capable of handling high-frequency trading activities.

Modern platforms provide leverage options up to 200x, though most professional traders rarely exceed 50x leverage due to increased liquidation risks. The most successful traders focus on platforms offering flexible margin options, allowing them to switch between isolated and cross-margin modes depending on strategy requirements.

Order Types and Execution Strategies

Advanced order types become crucial when trading with high leverage. Reduce-only orders help manage position sizes without accidentally increasing exposure, while post-only orders ensure favorable fee rates. Conditional orders allow for complex strategies involving multiple price levels and time-based triggers.

Market Analysis and Technical Indicators

Volume Profile and Institutional Flow Analysis

Understanding institutional trading patterns provides significant advantages in perpetual trading. Volume profile analysis reveals where large traders accumulate or distribute positions, creating opportunities for retail traders to align with institutional flow. These levels often become strong support or resistance zones that respond well to leveraged breakout strategies.

Monitoring on-chain metrics such as exchange inflows, whale movements, and futures open interest provides additional context for position timing. Large institutional movements often precede significant price movements, offering early signals for high-leverage strategies.

Advanced Chart Pattern Recognition

Traditional chart patterns remain relevant in crypto markets but require adaptation for high-leverage trading. Patterns like ascending triangles, falling wedges, and bull flags provide excellent entry points for leveraged positions when confirmed by volume and momentum indicators.

The key difference in leveraged trading lies in pattern failure management. High-leverage positions cannot tolerate extended drawdowns, requiring tight pattern invalidation levels and quick exit strategies when patterns fail to develop as expected.

The future of perpetual trading continues evolving with technological advances and regulatory developments. Traders who adapt their strategies while maintaining core risk management principles position themselves for sustained success in this dynamic market environment.