There’s something about economic recessions that brings out the entrepreneur in all of us. Yes, unemployment could be that ‘X’ factor. Historically, bad economic times meant fewer jobs, which meant people felt the need to be resourceful, which resulted in a lot more budding entrepreneurs than usual.

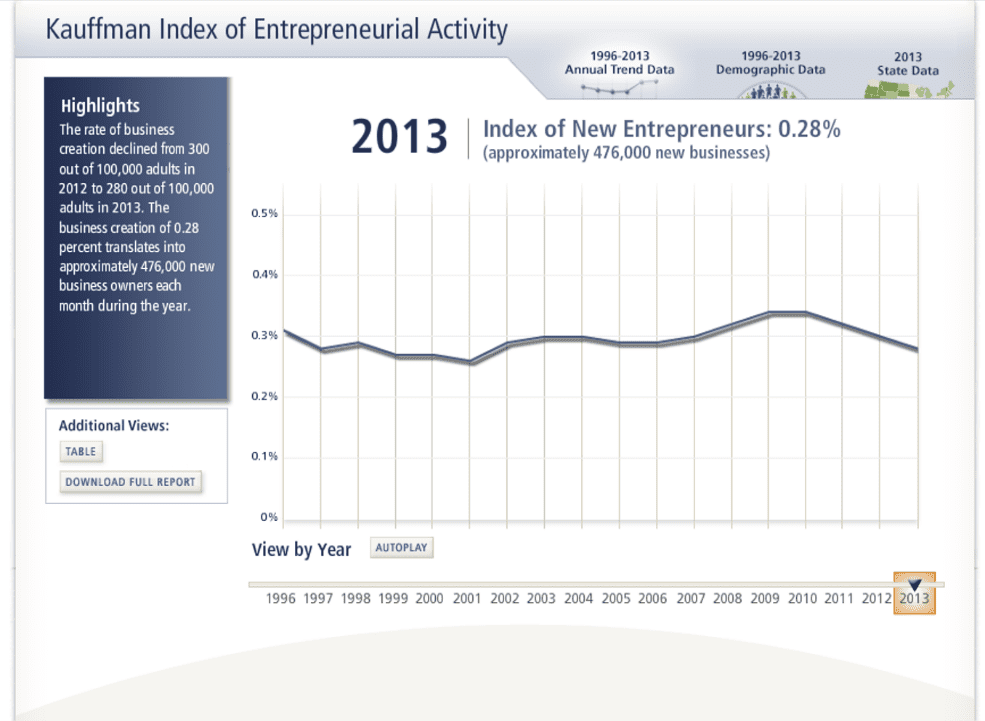

In fact one of the indirect measures that we are heading into better economic vistas is the fact that the rate of entrepreneurship has actually dipped in 2013 as compared to 2012. In 2013, 280 out of 100,000 adults were likely to start their own venture each month, as against 300 out of a 100,000 in 2012.

Source: Kauffman Index of Entrepreneurial Activity

The Center for Venture Research at the University of New Hampshire however noted that startup funding by angel investors actually went up by 8.3% in 2013 vis-a-vis 2012, reaching a total of $24.8 billion. About 70,730 startups received angel funding in 2013 – 5.5% higher than in 2012.

If you analyze these two data sets in conjunction, you’ll find that about 476,000 new businesses were launched per month last year leading to a total of 5.7 million new startups in 2013 alone. Of these 5.7 million new businesses, just 1.2% got funded by angel investors. The rest either bootstrapped it by themselves, scraped together bank loans, crowd funded or borrowed money from friends and family.

So, although it will be interesting to see how these figures have changed over 2014, the question here is this: what did this 1.2% of businesses that DID get funded do right to secure the finance they needed? How did they pitch to their angel investors to make them loosen their purse strings and put down hard cash? What are the rest of us ignoring in our elevator pitches that these 1.2% of startups got spot on?

#1. Understand Your Audience, Respect Their Time

Approaching an angel investor or a venture capitalist for funding is like approaching the pretty girl you see every day on the subway and asking her to marry you. She doesn’t know anything about you, she probably has a dozen other guys interested in her and to top it all the chances that she’ll say ‘No’ are almost 100%.

Do your research before you enter a pressure-cooker situation like meeting an angel investor. Understand their core strengths, what kind of business ideas they have funded in the past, what size of funding they can offer you, what expertise they bring to the table that will actually help your business. Incorporate these insights into your pitch to make it relevant to the potential investors. Successful startups generally create multiple versions of their elevator pitch – a different one for each investor group they pitch to.

Another crucial thing to keep in mind while making your pitch is that these are extremely busy individuals from whom you’ve stolen a minute to present your business idea. Respect the situation and the paucity of time to keep your pitch short and sweet. A good elevator pitch rarely exceeds a minute.

#2. Be Natural

People have a tendency to put on their ‘game face’ and ham it up to the max in pressure situations. Not such a good idea in an elevator pitch.

Yes, it is important to prep yourself in advance and present your ideas in a convincing, clear manner but don’t turn into Talkative Tom in the process. Most angel investors meet hundreds of over-eager ‘pitchers’ in their lifetimes and can spot a fake from a mile away. Stay true to your natural strengths and the chances of your pitch being a success multiply manifold.

Also, imagine the decision maker’s surprise when they give you an OK and you switch back to your regular Joe mode!

#3. Don’t Underestimate the Power of Technology

The traditional elevator pitch happens face to face, sometimes actually inside an elevator (make that, rarely). But as with everything else, technology can be your friend in making the speech that will change the course of your career.

With CXOs and top decision makers in VC firms easily accessible through social media, today’s elevator pitch can actually happen over a personal message sent via LinkedIn or Twitter.

If your perfect investor is not located in your city or even your country, you can still connect and pitch to them face to face via Skype, FaceTime or a recorded video link that can be emailed to their personal inboxes.

#4. Open with the Gist, Leave behind One Memorable USP

Many startup owners make the mistake of using a catchy story to hook the investors, only to lose track of their pitch somewhere down the line. It is quite natural to get an attack of the nerves and lose your way in such pressure situations.

Make sure you have an interesting, informative opening and a memorable closing line for your pitch.

Open with a one liner that captures answers to these three basic questions:

- What is your product/service?

- What problem does it solve?

- Whom does it target?

For example, you could start with “I have developed an app that helps doctors predict the exact number of years a heart patient can maintain good use of their pacemaker.”

Once you’ve told them what the core message is in the opening of your pitch, you have all the time in the world to build on it further by telling them the various benefits of your business idea and how you’ll go about executing it.

Make sure you close your pitch with a memorable benefit that is the USP of your business idea. The stickier your ending, the higher your chances of getting a call back.

#5. Giving Them a Reason to Believe

As pointed out earlier, the investor is usually a complete stranger who does not know you from Adam, and therefore, has no reason to believe in you.

For an elevator pitch to move to the next level, you need to build trust in your listeners. Start with your tone and body language – keep both positive and confident.

Support your statements with facts and figures that are verifiable. Throw in a real life example about a past client who strongly recommends your product or service. Offer to share those references so the investor knows that you’re not making stuff up.

#6. Practice Makes Perfect

Rehearse, rehearse and rehearse again.

An elevator pitch with a prized investor is an opportunity that comes along very rarely. Write down exactly what you intend to say. Keep it between 175 to 250 words and under 60 seconds in length. Cover the key aspects of your business focusing primarily on the problem that you will be solving and the key USP that sets you apart from competition.

#7. Pick up Subtle Cues from the Listener(s)

Most elevator pitches are delivered in one go – no stops, no pauses and barely any deviations from the script. This is probably why most elevator pitches fail as well.

A successful pitcher watches out for the barely there cues that help in strengthening a pitch. Watch out for changes in your listener’s body language, replies and adjust your message accordingly. See a spark of interest in their eyes when you mention the technical aspects of your idea? Go little deeper into the tech-specs than previously planned. Notice them glance at their watch impatiently? Change your pace and wrap up quicker.

#8. Get the Best Guy for the Job

Not everyone has the gift of the gab. A successful elevator pitch is about executing an outstanding piece of communication in a terribly short window of time.

If as a business owner, communication is not your strongest suit; get your business partner or marketing head to deliver the actual pitch. Pick someone who knows the business inside out and is a pro at getting the message across. After all, if your team had to win the 100 meters dash, you’d want Usain Bolt to run for you, right?

#9. Closing the Deal Is Not Necessary, Call to Action Is

Many startup owners make the mistake of pushing for an immediate answer or a ballpark investment figure from the investor at the end of their elevator pitch.

Don’t corner the investors. You almost always get a more positive response once they have had a little time to think it over and make up their minds. Don’t try and hurry the decision for them.

Source: Leo Reynolds on Flickr (used under CC license)

Instead, close with a clear request or a ‘call to action’ to the investor. Request them for a date to meet them at their office to discuss the idea further or ask them for their email IDs so you can send across a detailed presentation to them and so on.

The Bottom Line (at the Top)

While it is incredibly easy today to launch your own business, it is also unbelievably tough to secure VC funding for it. As the years roll by, competition is only going to get tougher. The only way to ensure that your business idea sees light of day without burning a giant hole in your pocket is by making sure you reach out to the right investors, at the right time, with the right message. Work on your elevator pitch till you hone it into a fine art before you present it to a potential investor. Keep working on your elevator pitch to make it better and more efficient constantly – more funds are always welcome!

As Babe Ruth famously said, “It is hard to beat a person who never gives up.”

__________________________________________________________________________________

Connect with Tweak Your Biz:

Connect with Tweak Your Biz:

Would you like to write for Tweak Your Biz?

Tweak Your Biz is an international, business advice community and online publication. Today it is read by over 140,000 business people each month (unique visitors, Google Analytics, December, 2013). See our review of 2013 for more information.

An outstanding title can increase tweets, Facebook Likes, and visitor traffic by 50% or more. Generate great titles for your articles and blog posts with the Tweak Your Biz Title Generator.

Connect with Tweak Your Biz:

Connect with Tweak Your Biz: