The moment for digital banking has arrived. Changes in consumer needs brought by the COVID-19 pandemic, as well as other factors, are rapidly transforming the banking industry from traditional teller-based branch banking toward a digital banking model.

Internet-based banking has been an option since the 1990s, but the COVID-19 lockdowns of 2020 have hastened the transition in unexpected ways. Banks are rushing forward to build new digital banking infrastructures and adapt their business models to accommodate customer desire for all-digital banking as well as to provide enhanced hybrid services.

A cultural mega-shift is underway that promises to shake up rigid banking structures, replacing or enhancing them with more agile, customer-centric digital architectures.

The COVID-19 pandemic has played a role in adopting a digital lifestyle, but the virus is only part of the reason why 2020 is the year of digital banks. Although accelerated by the pandemic, the change has been on the horizon for several years because of blockchain, big data, artificial intelligence, and peer-to-peer lending.

Rising consumer confidence in these new industries has further driven their adoption. The increasing number of neobanks (also known as disrupter banks) using these technologies has placed further strain on the traditional banking sector.

Digital-only banking models allow neobanks to offer better services at lower prices. Could they prove to be the nail in the coffin of conventional banking? Not quite yet, perhaps—but they are notable industry disruptors.

As 2020 progresses, expect to see digital-only banks claim an increasing market share. Below, we take a look at the driving factors that led up to this point.

Rising Consumer Confidence

According to Statista, the app Revolut’s customer base grew by 8.5 million between February of 2018 and February of 2020. European neobanks N26 and Monzo more than doubled their customer bases during the same period.

All three companies are mobile-only banks headquartered in Europe. Their phenomenal growth rate over the past two years points to increasing consumer confidence in their offerings. Consumers are beginning to recognize the benefits of digital banking solutions.

Big Tech Is Interested in Fintech

In April, Bank of America announced a partnership with the cryptocurrency platform Ripple. Forbes reported that Ripple achieved a market valuation of $10 billion in 2019. The mobile-only startup Revolut reached a record high of 10 million customers at the end of February 2020—and had achieved a market value of $5.5 billion by the end of May 2020.

More staggering was the news that the average valuation of the top ten fintech companies increased from $6 billion to $9 billion between 2019 and 2020.

It was only a matter of time before these unicorns attracted the attention of big tech. We saw a spark of that interest with the launch of the Apple card and Facebook Pay. And big tech is only getting started.

2020 will be another exciting year for big tech and finance. According to the Wall Street Journal, Google plans to offer clients checking accounts this year. It’s a departure from the company’s traditional market offering, but it makes sense in a world where the lines between traditional role players are blurring.

Big Data

The revised Payment Services Directive (PSD2) regulations in Europe take us one step closer to an open banking system. The laws force banks to share data with fintech companies and APIs (applied programming interfaces). According to the World Economic Forum, sharing information will further lower the entry barriers for fintechs.

The United States has no such legislation yet. However, it’s difficult to imagine that developments due to the European Union’s PSD2 will go unnoticed. The launch on an external API marketplace by the DTCC in February points to an early interest in the idea.

Better access to big data sets will enable fintechs to gain more ground in the financial services industry.

Artificial Intelligence

AI is changing the landscape by giving consumers access to more personalized insights. We’re increasingly seeing AI applications geared towards instilling better financial habits. AI-enabled software picks up patterns that indicate double-billing or fraud. It then guides consumers on how to rectify the issue.

AI may also identify patterns in consumer spending to create forecasts of weekly expenditures. Using this data, AI may alert a consumer when they’re spending too much—or warn them of upcoming debits and expenses that they must pay.

AI might also provide investment advice and help consumers find the right financial solutions. All of these AI capabilities reduce the need for direct interaction with a bank employee.

Significant benefits to players in the financial industries derive from artificial intelligence. AI can process vast amounts of data in seconds. Fintech companies are using this capability to offer customized products and individual risk assessments.

Companies like Kabbage and Avant use AI to determine the risk profiles of borrowers more accurately. They then use this data to match borrowers to p2p lenders with the appropriate risk profiles. Because of this, AI gives consumers access to a range of fast credit offers.

Blockchain Revitalization

Bitcoin came about in response to the global banking crisis of 2008. Bitcoin offered the unbanked a viable alternative to slow and costly bank transactions. Scaling issues and the volatility of the Bitcoin market slowed the adoption of Bitcoin as a cryptocurrency.

However, Bitcoin provided us with insight into the potential of the underlying blockchain technology. Hybrid models like Ripple and Ethereum are proving that the technology is workable.

The World Economic Forum has been an advocate for the broader implementation of the technology. To date, however, the technology has proven challenging to understand and properly implement.

Why? The two most prominent players in the market, Bitcoin and Ethereum, operate on a Proof of Work (PoW) model to validate transactions. The model requires consensus from several nodes within the network to verify transactions. However, this model presents challenges to scale up and also consumes tremendous amounts of computational energy.

PoW has also proven troublesome for the implementation of Ethereum’s smart contracts. As a result, Ethereum hopes to be changing over to a more practical Proof of Stake model in the coming year. If successful, smart contracts will become a viable option.

Final Notes

Conducting business online has become the norm for many consumers. While the banking industry has been slower to adapt, the events of early 2020 have triggered a rush to build new digital systems and transform the culture of banking to become more customer-centered. While brick and mortar banks are not disappearing from the landscape quite yet, the transformation to digital baking is well underway, made even more urgent by the current pandemic.

As conventional banks continue to retool to create digital solutions and compete with the tech-savvy digital-only neobanks that have shaken up the industry, 2020 promises to be a landmark year for digital banking innovations.

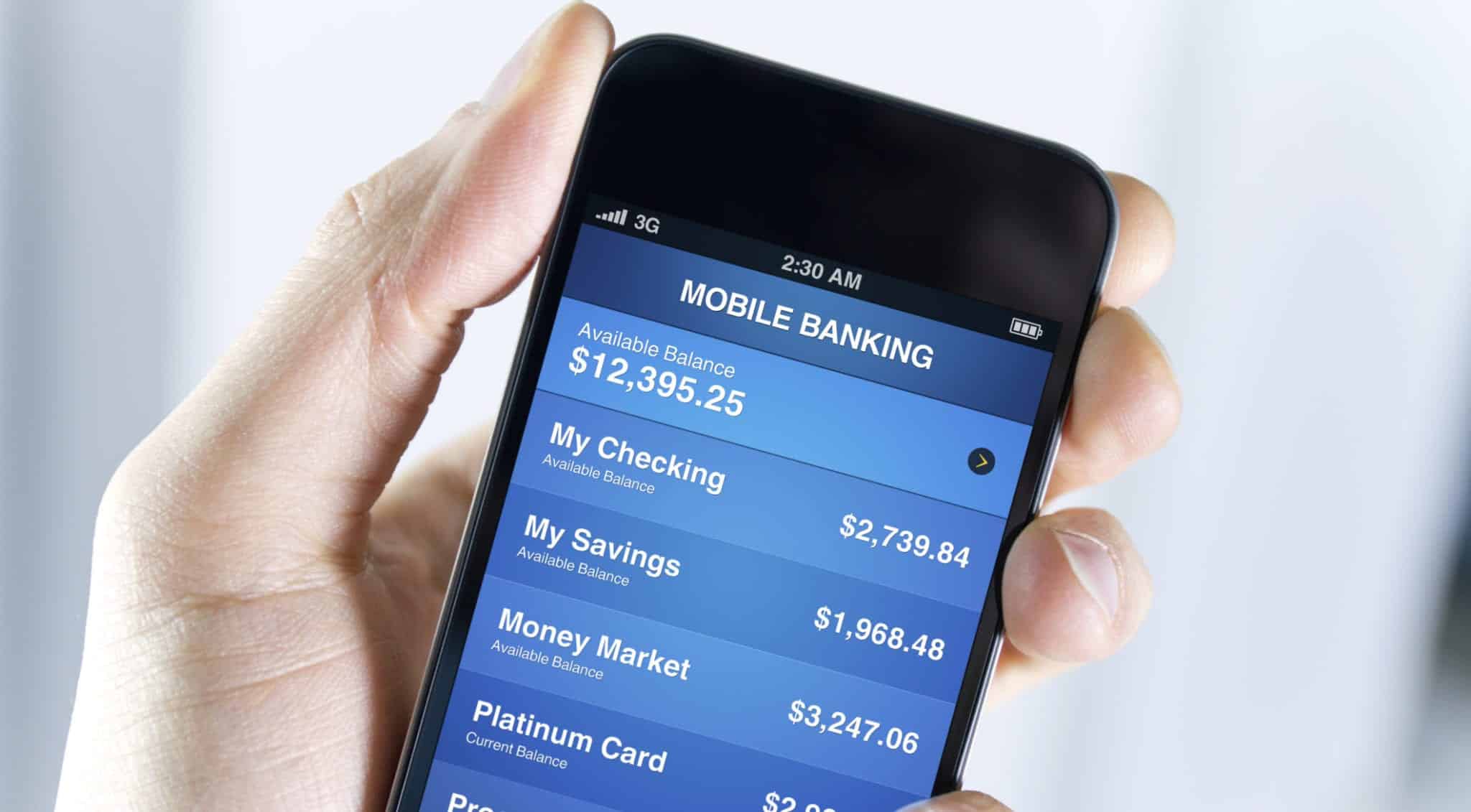

banking app on smartphone -DepositPhotos