There are a lot of people with great business ideas but there are only a few who manage to turn their ideas into a reality. Taking an idea and executing it is not an easy task. It is a long road that requires a lot of hard work and planning. Most of the entrepreneurs do not have any business running experience. Most of the startups fail to make it through the first year as they are not ready to handle the pressure of the industry. The reason for failure is mostly the finances. Startup entrepreneurs often get caught up in their business idea and end up spending the available finances on all the wrong things.

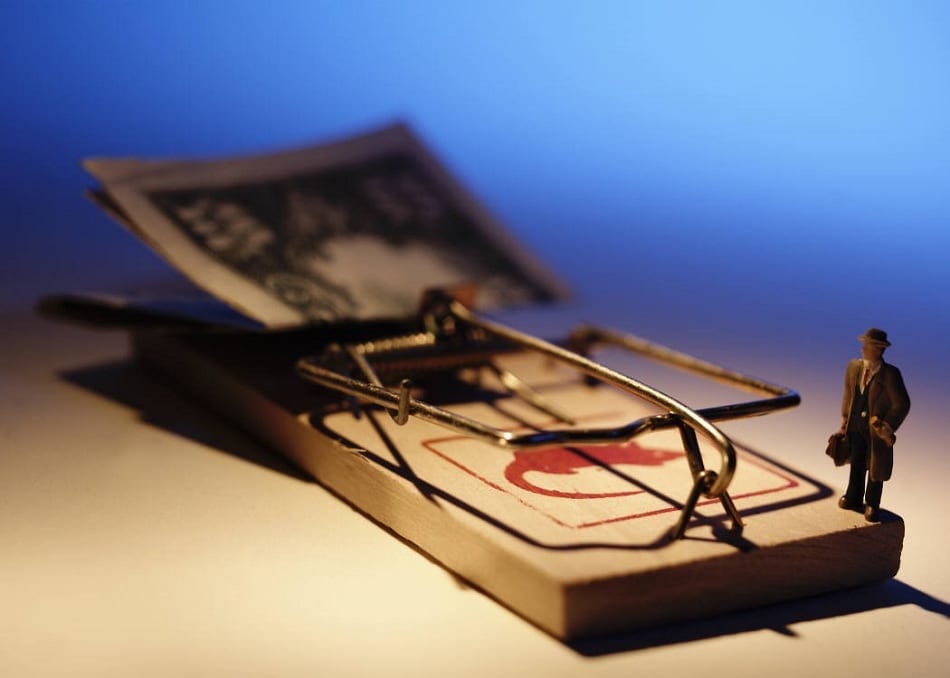

When you have an exciting business idea you want it to become a reality. Despite all the planning, the entrepreneurs can end up making bad decisions as they want their business to become functional. Before you start investing in your business idea then you need to be extra careful with each decision so that you do not end up making a financial blunder.

Here are some of the financial traps that a young business owner should stay away from.

#1. Not Separating Business and Personal Funds

One of the most common mistakes new business owners can make is not differentiating between the business and personal funds. It may seem like a small decision to the inexperienced start up owners. If you want to make sure that your business runs smoothly you should separate the finances. Keep the business and personal finances separate from the beginning. If you do not keep them separate then you will have a lot of difficulty in understanding how much money you have spent on different areas of the business. If you are not clear about the cash flow then it will be difficult to keep tabs on the financial dealing which is not good for the business.

Apart from financial problems it can also lead to legal problems. Combining the personal and business finances makes it difficult to keep a track of the expenses and can cause a problem when you are filing taxes. If you do not want the tax filings to go wrong then you have to draw a distinct line between the business and personal funds.

#2. Spending Without a Plan

Starting a new business is thrilling and when things are looking good in the beginning the people can often get caught up. The entrepreneurs find themselves to be optimistic as there are funds available. It is easy to get carried away when there are funds there. You may use the funds to renovate the place or think about adding something new which is not included in the business plan. J

ust because you have funds available you should not deviate from the business plan. Stick with the business plan so that you spend your money on the right things. You have to be extra careful about your spending when the business is young and in early stages. Make sure that every penny you spend is beneficial for the business and not just randomly spent.

#3. Careful About Hiring

Every business needs a staff so that all the aspects of business are handled properly and business runs smoothly. But the hiring process is not easy and even the best companies can get it wrong. The new businesses cannot afford to make the mistake of bad hiring. In the beginning the entrepreneurs should stick with a small team. Make sure that you pick the team carefully so you have a small talented team that can contribute to the company.

Every hire you make should have a role to play in the progress of the business. If there is any member of the team who is not contributing to the progress of the company should be let go. Keeping people on the job just because you do not want to fire them is not financially feasible for a young business. Over-hiring is not the best move for a new business.

#4. No Cash Reserve

Every new business should have a cash reserve because new businesses can often run into situations where you may need some extra cash. In the beginning the businesses do not have a steady revenue stream as they are not well-established. Every business can have a dry run as there is a lot of competition and to get your sales up you need to improve your marketing strategies. It is important that you have reserve cash because it is going to help the business in case there is a dry run and business is having a problem in getting some revenue.

#5. Unnecessary Large Loans

Running a business requires financial support and a lot of entrepreneurs handle the financial situation by getting loans. But when you are planning to get the loan you should know that you have to pay it back. The loans come with interest rates as well and if you take the wrong loan then you will find it difficult to pay the loan back. If the business is failing to make steady profits and you have to pay back the loan then the business financials will start faltering.

Before you take a loan, you should make sure that you have a comprehensive repayment plan. If you do not want the business finances to falter then you need to make sure that you do not take large loans that you cannot pay back. One of the best ways to avoid unnecessary load is to lease things. For examle, if you are in need of electronic equipment for a period of time then instead of taking a loan you can lease it easily.

#6. Ignoring Maintenance of Accounts

Most of the new businesses fail because they find it difficult to keep up with the accounts. It is critical for a business to have a detailed record of all business transactions and expenses. The bookkeeping is something that should never be overlooked. If you fail to maintain the accounts then you will not be able to get any tax reliefs. The entrepreneurs mostly don’t have much experience when it comes to handling the finances. It is best for the business to hire an accountant so that the accounts are maintained properly.

To run a successful business, it is essential to pay special attention to the finances. The future of the business depends on your ability to handle the financial planning and executing the plan without the slightest error.