Technology in the tax department is on the rise.

The tax department has become one of the most high-tech places in a company. The industry is constantly changing and to keep up with the ever-evolving rules and regulations, businesses are turning to new tax technology. Along with the need for new tax technology is the demand for tech-savvy professionals who know how to use it. Professionals who understand how to protect a company from security breaches, prevent data loss, streamline a company’s data transfer process, build automated reports, and integrate new technology systems with a company’s existing software are in hot demand right now.

If you’re currently a tax professional, or thinking about getting into the field, learn more about the latest tools and technologies companies are using, and how to become a competitive force in the industry.

Tax Department Tools and Technologies

Keeping up with the latest tax liabilities and the rules and regulations surrounding them can be a challenge for any company. Emerging tax technologies help companies save time and money by automating procedures, which also reduces the risk of human error.

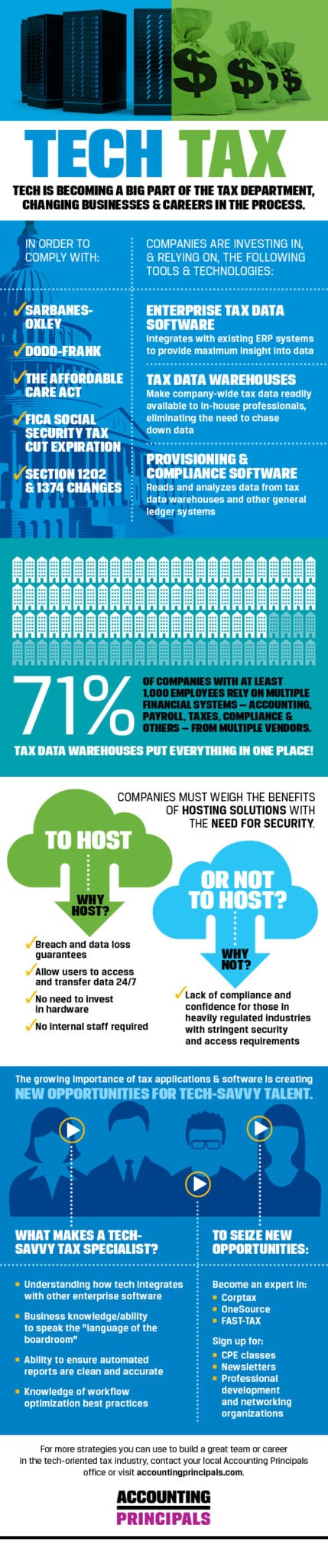

In order to comply with Sarbanes-Oxley, Dodd-Frank, the Affordable Care Act, FICA Social Security Tax Cut Expiration, Section 1202 & 1374 Changes companies are relying on and investing in the following tools and technologies:

- Enterprise Tax Data Software: Integrates with existing ERP systems to provide maximum insight into data.

- Tax Data Warehouses: Make company-wide tax data readily available to in-house professionals, eliminating the need to chase down data.

- Provisioning and Compliance Software: Reads and analyzes data from tax data warehouses and other general ledger systems.

An overwhelming 71 percent of companies with at least 1,000 employees rely on multiple financial systems from several vendors, including accounting, payroll, taxes, compliance, and others.

Tax data warehouses put everything in one place. They serve as a the one source a company can rely on to provide them with all necessary information to make accurate decisions based on complete current and historical data.

Both companies and professionals must embrace these new technologies to remain a competitive force in the industry. This places a high level of importance on continuous professional development in the latest tax applications and software, keeping up with emerging best practices, and taking the initiative to seek continuing education and certification.

New Opportunities for Tech Savvy Talent

The growing importance of tax applications and software is creating new opportunities for professionals with tech skills. Companies need these workers to analyze complex financial data and prepare more detailed reports that the business relies on. These professionals must have a broad understanding of emerging tax technologies and have the ability to easily adapt to change.

Companies expect a tech savvy tax specialist to have the following qualifications:

- Understanding of how tech integrates with other enterprise software.

- Business knowledge and the ability to speak the “language of the boardroom.”

- Ability to ensure automated reports are clean and accurate.

- Knowledge of workflow automation best practices.

To remain competitive in the field, you’ll need to become an expert in Corptax, OneSource, and FAST-TAX, if you aren’t already.

It’s also important to sign up for Consulting Professional Education (CPE) classes, industry newsletters, and professional development and networking organizations, such as the National Association of Tax Professionals and the National Association of Tax Consultants.

Working in the tax field has never been as exciting as it is today. This constantly evolving field is always filled with new opportunities to learn and expand your industry knowledge. Just remember ─ the more you learn, the greater value you can offer your company.

__________________________________________________________________________________

Connect with Tweak Your Biz:

Connect with Tweak Your Biz:

Would you like to write for Tweak Your Biz?

An outstanding title can increase tweets, Facebook Likes, and visitor traffic by 50% or more. Generate great titles for your articles and blog posts with the Tweak Your Biz Title Generator.

Get Featured On Tweak Your Biz – #TYBspotlight