Successful or not, small business owners are an odd bunch. They are distant from others, absorbed in self-motivating ideas and chased by the dream of success. No wonder they often lose touch with the reality.

The obstacles they face in their way bring them back to the real world. How to raise funds is one such obstacle. Small businesses are mostly startups and fundraising is an existential challenge for them.

Whether it’s launching an ecommerce site or laying the foundation of an physical retail outlet, small business need money to start out.

Does bootstrapping help?

It does help but only for a short while. Bootstrapping is not a recommended way to raise money for all types of businesses out there, and it has problems in spades.

Online businesses, barring the ones that are brand sponsored, are self-employed. But offline ventures, especially in the brick and mortar industry cannot run on bootstrapping, not even for a short while.

There are five viable ways to fund a startup/small business. These are listed below:

#1. Crowdfunding

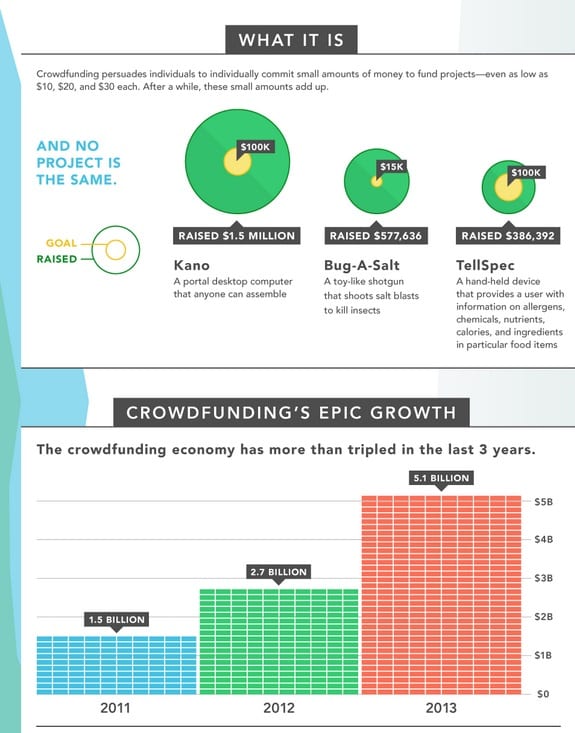

Crowdfunding that garners operating capital for small businesses, has flourished by harnessing the power of the internet. Crowdsourcing resembles crowdfunding – one is for allocating a work, another is for raising fund.

The infographic below shows the growth of crowdfunding:

The most popular among crowdfunding platforms is Kickstarter. It’s not the only platform, though. Here’s a list of crowdfunding sites. What’s interesting about crowdfunding is both nonprofits and for-profit organizations can use it unlike VC funding, which is entirely profit-centric.

Crowdfunding is better than bootstrapping. The money you obtain is not a loan, so no question of returning it with interest rates. It’s not donation either as people who fund your business want a share in your profit. In case of VC funding, money comes from only one source, whereas in case of crowdfunding it comes from a crowd.

A successful crowdfunding campaign puts some psychological tactics to use. As your appeal is to the mass, knowing how mass psychology works may help. You raise money for the development/launch of a product and not for your business. So make sure the product idea is interesting, and work tirelessly on the product so it’s released as a high quality product.

The problem with crowdfunding is the money raised is too small as an amount. A large amount of money comes from

Business incubation programs

Business incubators are known colloquially as accelerators. A business incubator was defined by Entrepreneur as:-

“An organization designed to accelerate the growth and success of entrepreneurial companies through an array of business support resources and services that could include physical space, capital, coaching, common services, and networking connections.”

Such an organization may or may not be for-profit. The International Business Innovation Association (InBIA) is a global nonprofit organization with 30% of their members from outside the US and helps entrepreneurs from around the world.

Since rejection is too common, small business owners need to create a checklist before looking into accelerator programs. They may feel distraught over the finding that 90% of accelerators will fail. Incubators offer mentorship and networking apart from monetary help, through which they retain some control, which, in some cases, infuriates the business owners. Despite these downsides, many startups line up for getting into incubation programs.

Venture funding

Should a small business owner let his dreams die after meeting with refusal from a business incubator? Not at all. There are venture capital (VC) firms who can make his dream come true.

Unlike business incubators, VC firms are all profit seeking bodies. They don’t work with nonprofits and through investing in a small business, they secure private equity stakes in it.

Having a VC firm investing in your startup is not a cakewalk, though. They look forward to invest, but only in startups that have products or ideas worth incentivizing. In the 2015 Product Hunt Singapore Meetup, the speakers categorically outlined the product development and testing strategies that startuppers need to adopt to be able to attract series A VC funding.

Downsides of VC funding can be readily apprehended or sublime. The short timeline is the former type. VC firms rarely show interest in products that’ll take more than 3 years to yield a favorable return. A sublime downside is the trained negotiators, employed by VC firms use the funding spree as more of a leverage for their own benefit, not so much for the startup’s benefit.

VC funding is a convenient way for small businesses to gather money but the problem is VC firms invest to swell up a startup’s profit. For seed stage funding the assistance comes from

Angel investors

Angel investors pour less money on a small business compared to a VC funding. The rationale behind this is angel investors are individuals, not organizations, and they shower only the seed stage funding or the operating capital.

There are pros and cons of receiving funding from angel investors. The advantages include a less rigorous qualifying procedure. Since angels are individuals, they can be found and pursued using personal contacts. Startups don’t require more than $500000 in the early stages. Angel investors are rich people and they can shell out this amount quite easily.

The infographic below shows how angel investment is fueling growth:

Angel investors are tolerant to risks, but they want their investment to be paid off. They expect a return that’s 10-20 times higher than the money originally invested, due to which, small business owners function under tremendous pressure. Such intense pressure is not conducive for a business environment.

An angel investor determines the stake in a small business depending on the amount he invests. If he invests a substantial amount, he’ll ask for a larger stake. The lion share of the profit earned by the company will go to him. He’ll also be the decision making figure having the last word and the small venture might lose its autonomy.

Small business loan

This is the oldest way to raise fund for a small business. Oldest but not effective any more as bank loans are hard to obtain these days. The United States is facing an economic slowdown due to mounting debt, clocking at $18 trillion. This makes banks unwilling to grant loans to small business ventures.

The Federal Reserve has observed business loan stagnation of $1.52 trillion. Bob Seiwert of American Bankers Association explained this stagnation saying “there is a liquidity crisis. Banks need money to lend. If they can’t sell the loans on their books, they can’t get money to make loans to you and me…”

Despite the difficulties, many SMBs are still securing bank loans. Before approving a loan request, a bank would look for few things. Increase the chances of getting a loan by understanding all criteria and show banks proofs that your business is performing well. Most importantly, improve your credit score. A credit score below 620 diminishes your chances of getting a loan.

After getting rejected by banks, small business owners look for alternative lending options. While alternative lending agencies have a higher approval rate compared to banks, the terms and conditions are often not clear. The Small Business Borrower’s Bill of Rights identifies 6 rights for anyone who borrows money to start a small business. Before applying for a loan from an alternative lender, check if the ToCs preserve these rights.

Conclusion

Once small business growth swept across the United States but now, the growth has slowed down. The turf is hard, you need to put soccer shoes on. The five fundraising strategies discussed here are the soccer shoes, from which you can choose one.

Images: ” Author’s Own”

______________________________________________________________________________

Tweak Your Biz is a thought leader global publication and online business community. Today, it is part of the Small Biz Trends stable of websites and receives over 300,000 unique views per month. Would you like to write for us?

An outstanding title can increase tweets, Facebook Likes, and visitor traffic by 50% or more. Generate great titles for your articles and blog posts with the Tweak Your Biz Title Generator.